CY22e trading update

CGC’s CY22e trading update quantifies the impact of the citrus quality issues while highlighting reasonable trading conditions across the remainder of the portfolio. Key points:

Citrus quality issues: The QLD crop has been harvested and packed and the southern crop (Sunraysia & Riverland) is ~80% complete. The impact of the quality issues highlighted in Jul’22 has resulted in considerably lower pack out rates (20% below budget), lower average pricing outcomes (lower grades) and higher costs.

CY22e guidance: At this stage CY22 EBITDAS is expected to be modestly ahead of CY21 levels, implying ~$220m versus consensus of $230-266m, midpoint of $251m and BPe $263m. The group is operating within all balance sheet covenants.

CY22 pricing trends: YTD22e Pricing trends have been favourable, with average domestic wholesale prices (ex-avocado) up ~15% YOY, export citrus flat YOY and QLD wholesale avocado prices through the peak selling widow up ~20% YOY.

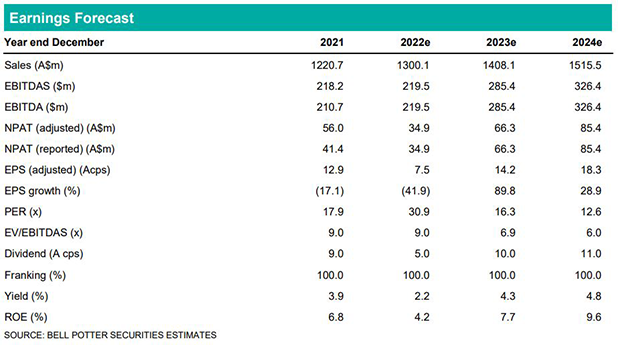

Following the update we have downgraded our EBITDAS forecasts by -16% in CY22e, -3% in CY23e and -2% in CY24e. CY23-24e changes reflect weakness in the AUDUSD impacting dollar sensitive costs (fertiliser & ag-chem). Our NPV target price falls to $2.75ps (prev. $3.55ps) following these changes and adoption of higher discount rate hurdle (+60bp).

Investment view: Buy rating unchanged

Our Buy remains unchanged. Our favourable view on CGC is driven by: (1) expansion and maturation of the international berry operations; (2) expansion and maturation of the avocado orchards; (3) maturation of the citrus orchards driving a material uplift in production volumes; and (4) generating returns on investment in new farming capacity (avocado, citrus and tomato) to grow earnings CY22-26e. The CY22e citrus quality issues appear seasonal rather than structural in nature and as such we do not see them as a recurring impact on the business under more normal seasonal conditions.