Quarterly production and revenues weaker

BPT reported quarterly production of 5.2MMboe (BPe 5.4MMboe), down 8% QoQ, driven by major producing assets performing below expectations, particularly at Western Flank (impacted by flooding) and the Victorian Otways (wells experiencing faster than expected field decline and a legacy well ceasing production). The weaker production, a timing revision relating to revenue recognition for CBJV sales and weaker realised energy prices resulted in lower headline quarterly revenues. Adjusting for the accounting change, pro forma quarterly revenues were in line with our estimate (BPe $438m). At quarter-end, BPT maintained a net cash position of $38m ($165m at 30 June 2022) and available liquidity was $638m ($765m at 30 June 2022).

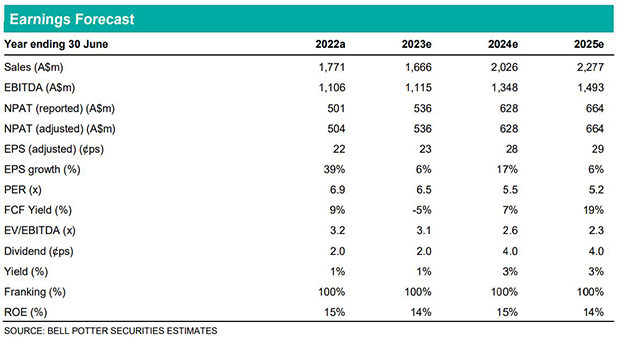

EPS revisions reflect changes to our oil price and FX outlook, production assumptions and operating and capital cost estimates: FY23 -1%; FY24 3%; and FY25 2%.

Growth projects on track despite apparent risks

The Waitsia development expansion (from 20TJ/day to 270TJ/day, gross) remains on track for completion before BPT’s first LNG sales target in 2H 2023. This indicative development timeline is despite a number of apparent construction risks impacting Western Australian projects including materials price inflation and supply chain disruptions (though reportedly easing). Recent media reports have highlighted Clough, the engineering, procurement and construction contractor for the Waitsia expansion, is facing working capital shortfalls. Production ramp-up at Victorian Otways is BPT’s other major near-term catalyst, with 5 new wells coming online by mid-2023.

Investment thesis: Buy, Target Price $2.20/sh (prev.$2.30/sh)

BPT has a strong, fully funded energy production growth outlook. This production growth is diversified across five energy basins and across four separate gas markets, including the global LNG trade. The company should benefit from tightening east coast gas markets and international LNG markets flowing through to higher realised prices. BPT is trading at lower earnings multiples compared with its ASX-listed peers.