Unleashing the Future of Enterprise Asset Management

COSOL Limited (COS) is an ASX-listed company operating in Australia and North America. With a foundation established in 2000, COSOL specializes in digital IT solutions, focusing on enterprise asset management software platforms and data management. As a global leader in enterprise asset management (EAM) technology-enabled solutions, COSOL optimizes operations in asset-intensive industries, including natural resources, energy and water utilities, defence and public infrastructure.

Compelling value proposition

The information presented highlights the compelling value proposition of COSOL in the Enterprise Asset Management (EAM) Industry, with strong financial growth, a diverse client base, strategic partnerships, and a focus on sustainability, COSOL demonstrates its ability to deliver innovative solutions and drive industry-wide transformation. The company’s ownership alignment, international expansion, and scalable business model positions it well as a leader in the market. As the EAM software market continues to grow, COSOL’s suite of digital technology solutions and forward-thinking approach position it well for future success.

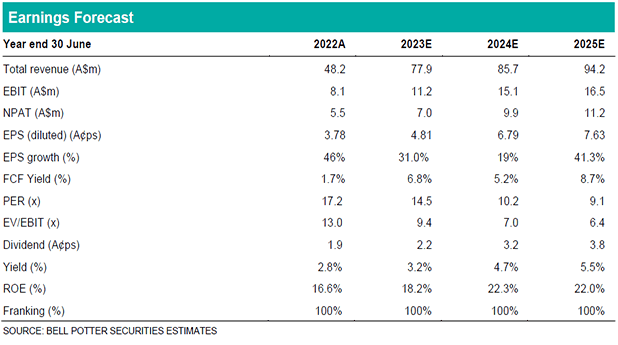

Investment view: Initiate with a BUY rating and $1.00 PT

We initiate coverage of COSOL, with a buy recommendation and a 12 month price target of $1.00. The price target is generated from a blend of three valuation methodologies we apply to the company: DCF, EV/EBIT and PE Ratio. We have opted to apply a 10% premium, to the average EV/EBIT and PE multiples of the listed peers. While this premium may be considered moderate, we conclude that a moderate premium is warranted given the robust contract pipeline in Australia and North America with an ambitious growth agenda through organic means and acquisitions to sustain growth in the future. In our view COSOL shows value on a FY23 EV/EBIT and PE Ratio of <10x given the strong footprint and forecasted strong growth in FY24 and FY25.