Path to doubling & extending Otway production

COE has released updated details of its near-term Otway Basin development plans, outlining a path to more than double existing output and extend the project’s life. The Otway Phase 3 Development (OP3D) will now focus on developing the Annie field before targeting low risk and high deliverability prospects to further expand production. With capital efficiency the key focus, further development of the Henry field has been deferred to beyond the OP3D horizon. Under the revised outlook, we estimate COE’s net Otway production will grow from around 13TJ/day in 2022 to more than 30TJ/day in 2026, and complement Sole production of around 65TJ/day. OP3D will enter Front End Engineering Design (FEED) in the September 2022 quarter for a Final Investment Decision (FID) in early 2023 and first gas by winter 2025.

Guidance revised on a strong end to the year

COE has also revised guidance for FY22 on account of higher spot gas prices and improved performance at the Orbost Gas Plant. Gas prices have averaged over $35/GJ in recent days, compared with $9.47/GJ in the March 2022 quarter. Following recent upgrades and an absorber clean, the Orbost Gas Plant has processed Sole gas at record rates of up to 65TJ/day. COE are now guiding to FY22 EBITDA of $57-68m (previously $53-63m).

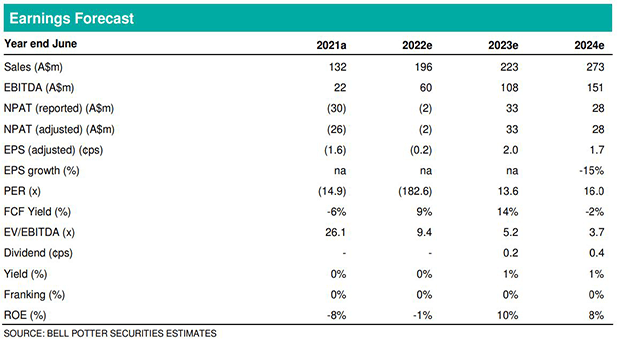

Investment view: Buy, Target Price $0.33/sh (from $0.38/sh)

Our Buy recommendation is retained, supported by strong Australian east coast gas market supply-demand fundamentals and COE’s portfolio of conventional gas assets. Over FY23, we expect COE to further de-risk its current operations and provide more detail the company’s growth ambitions across its Otway and Gippsland production hubs. COE’s forthcoming debt refinance should provide more development flexibility; with the company’s net zero carbon emission objective assisting with lender support. Changes to EPS in this report: FY22 -0.2cps (previously -0.5cps); FY23 -15%; and FY24 -16%.