USA/ANZ performing strong, UK facing ST logistics issues

At its AGM today, CCX provided commentary on trading for the FYTD, as follows:

- Strong sales growth, underpinned by the USA: CCX stated it has “achieved strong total revenue growth and comparable sales growth so far in FY22.” The USA, which is now CCX’s largest market based on active customers and website traffic visits, continued to achieve strong growth – Avenue.com continues to trade above pre-acquisition levels while City Chic US online has recovered to strong growth levels. In ANZ, stores in NSW/VIC have traded well since reopening while online continues to be strong and has not slowed following store re-openings. In the UK, following a strong start, Evans has moderated into autumn/winter due to logistics issues. We note, the UK and Europe is still a relatively small percentage of CCX’s global business at this stage (EMEA accounted for ~6% of FY21 sales).

- Well stocked in key USA / ANZ markets ahead of peak trading period: Global shipping continues to be a challenge, although CCX has mitigated risks on costs and timing. On a cost level, CCX’s increased volumes have resulted in greater buying power and lower input costs; while on a timing level, CCX has added an additional two month’s lead time into shipping and production. With this, CCX is well set for the peak trading period ahead in ANZ and the USA. In the UK, labour shortages and logistics issues have impeded inventory build, although this is a transient situation with CCX working with its logistics partner to resolve the issue.

- FY22 earnings to be skewed to 2H22, as we expected: Reflects: 1) ANZ 1H22 lockdowns; 2) development profile of Evans/Navabi; 3) ramp-up of marketplace partners; & 4) the ongoing shift to USA/UK which are seasonally stronger in 2H.

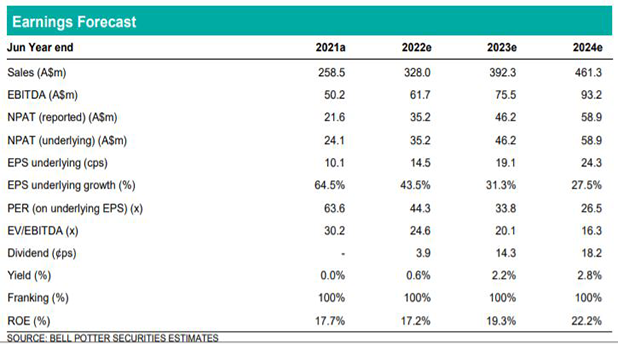

Earnings changes & Investment view: Retain Buy, PT $7.40

We expect the strength in the USA will offset short-term logistics issues in the UK, and hence make no material EPS changes in FY22-FY24. Stronger long-term assumptions in the USA and time-creep increases our price target to $7.40 (previously $7.05). The combination of CCX’s significant global growth prospects, flexible business model, ample funding headroom, favourable industry tailwinds and strong management team, is attractive. We retain our Buy rating on the stock.