Strong FY21 result, EBITDA slightly ahead vs 26 July update

BST delivered a strong debut FY21 result that was well ahead of Prospectus forecasts and slightly ahead of the company’s 26th July update. FY21 pro-forma EBITDA (preAASB16) was $71.6m, 18.0% ahead Prospectus & well up on pcp of $27.0m. EBITDA (post-AASB16 basis) was $124.4m, slightly ahead vs BPe $121.3m. The result was underpinned by +10.8% like-for-like (LFL) sales growth, with total sales up 6.1% to $663.2m (0.8% ahead vs Prospectus). Of this, 9.2% was online sales (up vs 7.3% in the pcp). The result was also underpinned by strong margin gains reflecting a clearer pricing strategy, a heightened focus on inventory management, and continued focus on cost control. BST exited FY21 with pro-forma net cash of $35.7m.

Lockdowns obviously impacting, although levers to cushion

BST provided a trading update for the first 8 weeks of 1H22. Key points are: 1) total sales are down -25.7%, with LFL sales down -11.7% on FY21 & flat on FY20; 2) gross margin is ahead of expectations; and 3) tightly managing inventory, costs & cash flow.

BST reaffirmed its Prospectus pro-forma EBITDA & NPAT forecasts for CY21. For the 1H22 period, achieving Prospectus forecasts remains dependent upon the intensity and duration of lockdowns. While lockdowns will result in a shortfall in 1H22 sales, this is expected to be cushioned by: a better-than-expect start for Postie (pre lockdowns); a favourable FX hedge on COGS; cost saving measures in response to lockdowns; and an expectation consumer demand will rebound in Nov/Dec should restrictions lift.

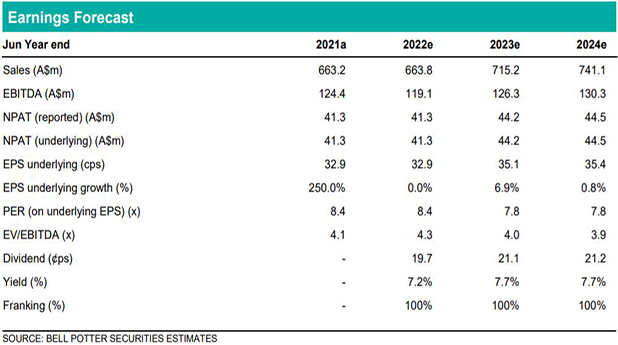

Earnings changes & Investment View: Retain Buy, PT $3.30

We already assume a moderate miss vs 1H22 Prospectus EBITDA (due to lockdowns which we assume will continue to end of October), although expect CY21 Prospectus EBITDA will be exceeded. We remain comfortable with our forecasts and our PT is unchanged at $3.30. We believe BST is well positioned in the current environment given its strength in defensive essentials such as baby / kidswear, value-quality market position (trading-down behaviour by mums is a likely tailwind), plus opportunities to expand in womenswear and further strengthen online capabilities. BST trades at an undemanding FY22 PE of ~8x, with an attractive ff yield of >7%. Buy rating retained.