1H21 Results at a glance

CGC reported a 1H21 underlying EBITDASL in line with expectations at $124.4m (BPe $124.0m). Key operating statistics of the result included:

Operating results: Revenue of $612.4m was flat YOY (vs. BPe $617.0m and guidance of ~$627m). EBITDAS of $124.4m up +4% YOY (vs. BPe of $124.0m and guidance of ~$124m). Underlying NPATS of $44.4m was up +4 YOY (vs. BPe of $44.0m and guidance of ~$44m). Headline results included ~$2.5m of COVID-19 disruption costs in the business ($10.4m in CY20) and ~$25m revenue impact from hail damage to citrus and grape crops.

Cashflow and balance sheet: Lease adjusted operating cashflow of $49.2m compares to a cashflow of $48.7m in 1H20. Net debt exited the period at $208m, compared to $143.9m in CY20. Post balance date CGC completed the acquisition of 2PH citrus and its associated equity raising.

Outlook: CY21 guidance is unchanged with EBITDAS and NPATS to be marginally ahead of CY20 excluding the acquisition of 2PH. Citrus crop and yield is in line with expectations and demand is strong from key Asian markets heading into 2H21e; while berry pricing has been positive YTD. Citrus and Berries are the largest two commodity drivers for 2H21e.

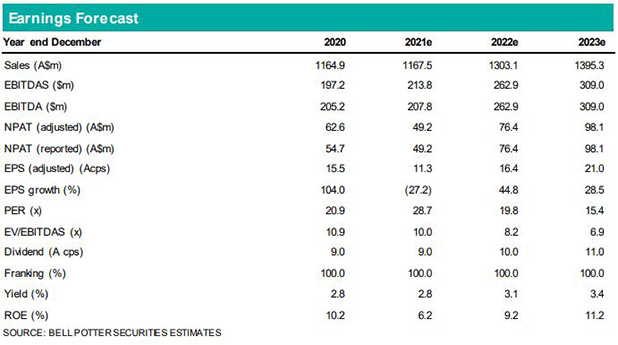

Following the result we have made no material changes to our CY21-23e EBITDAS forecasts. Our target price also remains unchanged at $4.30ps.

Investment view: Retain Buy rating

Our Buy remains unchanged. Our favourable view on CGC is driven by: (1) expansion and maturation of the international berry operations; (2) expansion and maturation of the avocado orchards; (3) non-recurrence of hail impacting citrus and grape operations in CY21e; and (4) further investment in capacity (avocado, citrus and tomato) to grow earnings beyond CY21e. In the near term we note reasonable export citrus pricing and strong off season berry pricing trends as supportive of the 2H21e outlook.