Banks fleeced by the RBA again, new headwinds emerging

Following the RBA’s decision to lower the cash rate by 25bp to 0.50%, we have decided to rebase sector earnings expectations in this note. This is in anticipation of slowing home and business lending growth and another 25bp rate cut perhaps in April linked to COVID-19. We use two methods to determine the earnings impact of the rate cuts. The first relies on extrapolated CANSTAR estimates to assess net interest income (NII) foregone while the second is based on actual bank SVR reductions that are then doubled. Further assuming potentially lower deposit and wholesale funding rates and taking the average NII foregone across the above methodologies, FY21 cash earnings impacts are estimated as follows: (1) ANZ -4%; (2) CBA -7%; (3) NAB -4%; (4) WBC -8%; (5) SUN bank -17%, Group -5%; (6) BEN -7%; and (7) BOQ -5%.

In addition to downward NII and NIM revisions, lending volume growth will also likely be impacted. In our CBA note of 3 March, we anticipated 1% lower home and business lending growth to 3% p.a. flowing from lower GDP – the assumption being a long run credit multiplier of 2x GDP and that GDP is reduced by 0.5%. At the Senate estimates economics committee meeting yesterday, the RBA lowered GDP by 0.5% – the impact largely coming from tourism and education – and this is consistent with the OECD’s current assessment for the country. We have also determined relative bank susceptibility to geographic and industry segments that may be impacted by COVID-19 as well as other outstanding risks. Supported by stronger CET1 ratios, we believe MQG, SUN, ANZ and CBA are most resilient in sustaining dividends at current levels.

MQG still our most preferred bank

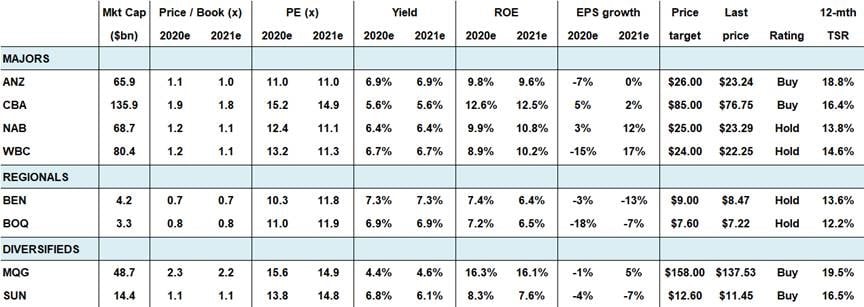

With the exception of MQG, earnings estimates across the forecast horizon are lowered by 7% on average for the majors and by 10% on average for the regionals (not surprising for the latter given their lack of scale) and price target reductions are similar in magnitude. Ratings for NAB and BOQ are lowered from Buy to Hold based on higher operating risk perceptions. MQG’s $158.00 price target and Buy rating are unchanged and the company remains the top pick across our coverage universe.