CMS Approves Transitional Pass-Through Payment

The company announced that the Centre for Medicare/Medicaid (CMS) has approved a new reimbursement code that will provide separate payment for Recell devices used in the outpatient setting. The Transitional Pass-Through Payment (TPT) is expect to reimburse hospitals for approximately US$6,200 related to the use of the device. The event represents an important breakthrough for the company and further validation of the clinical benefit of the Recell technology. TPT’s are reserved for devices that offer substantial clinical improvement over the standard of care and are made available where the cost of the device would otherwise represent an obstacle to patient benefit.

The TPT comes into effect from 1 January 2022. The company plans a launch amongst a small number of existing hospital clients to ensure commercial payers follow suite with the CMS. A larger scale roll out will follow in the back half of CY22 (1H FY23) to specialist burns hospitals. The serviceable market in burns is estimated at US$260m of which small burns with total body surface area is in the range of 5-10% comprises ~US$60m. The TPT will be appropriate for treatment of these wounds.

Today’s announcement had been foreshadowed in numerous company updates and represents the first in a series of high profile news flow. Recell is expected to gain a broad label approval from the Japanese PMDA this quarter that may include Vitiligo in addition to burns, trauma and pediatric use. In the clinic the company expects to enroll the final patient in the Vitiligo trial this quarter. Initial proof of concept data is also expected in Epidermolysis Bullosa and facial rejuvenation.

Investment View: Maintain Buy Rating, Price Target $9.80

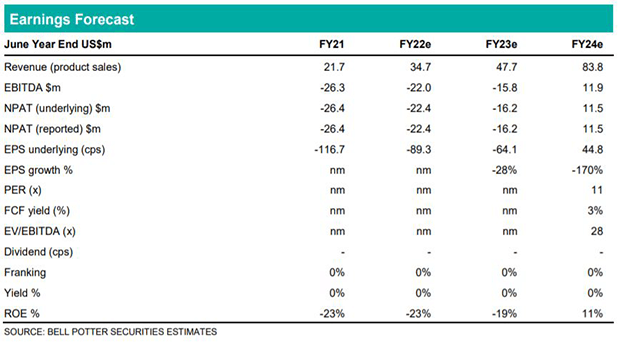

1Q22 results are due next week. Guidance is for commercial revenues of US$7m relative to US$6.8m from 4Q21. FY22/FY23 revenues are upgraded by 5% and 12% respectively related to the TPT code. The FY22 EBIT loss is reduced by ~$8m to ($22.4m) largely attributable to the rationalisation of the expected scrip based remuneration which has now been adjusted to be more consistent with the prior year charge. We maintain our Buy rating and price target of $9.80.