WOW unable to make the numbers stack up

Following completion of due diligence the WOW Board has decided to withdraw its cash bid for API. The bid, which was highly conditional and non-binding, had the support of the API Board. API will now proceed with the WES bid at $1.55 (less the 2 cps final dividend).

The notice from WOW withdrawing the bid is brief on detail citing only that the company had not been able to validate the financial return it requires. Fair enough, however, one wonders what, if anything, was uncovered during the due diligence process that led to this conclusion. The key risks in the transaction related to the ACCC sign off, WOW’s future interaction with the Pharmacy Guild and the 19.3% blocking stake held by Wesfarmers. These should have been identified prior to the bid and the due diligence exercise itself should have been relatively straight forward.

The WOW bid valued API at ~$1.01bn (Enterprise value) which implied a year 1 return on invested capital (based on BPe for FY23) of ~7% before any synergy savings or other value add. So why did WOW and before them SIG pull out? In SIG’s case it is not unreasonable to assume its internal management issues (which have since emerged) were a contributing factor, while for WOW the potential of a modest 7% return on capital combined with a likely protracted period of less than 100% ownership of API may have contributed. WOW may have been required to pursue a messy takeover bid rather than the more efficient Scheme of Arrangement (SoA). All of these factors were in plain sight at the time of the WOW bid announcement, hence API investors can quite rightly only ponder the motivation of the ill fated WOW bid.

Investment View: Retain Hold, Price Target reduced to $1.53

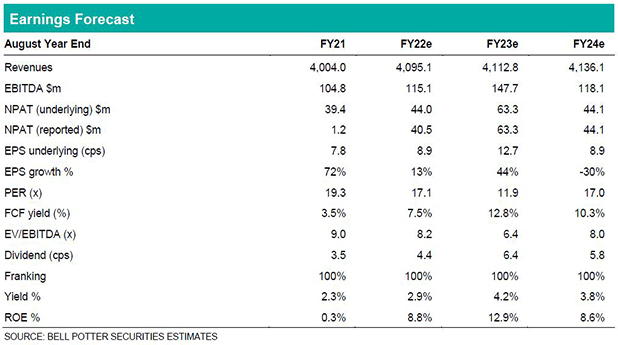

No changes to earnings. Price target reduced to $1.53 matching the WES cash offer (after the 2 cps final dividend). If anything the episode highlights the superior strategy of the WES group in establishing its 19% holding prior to going to public with its bid. We now expect the WES Scheme meetings to proceed later this quarter. The WES bid remains subject to ACCC sign off and the normal SoA approvals.