Result in line

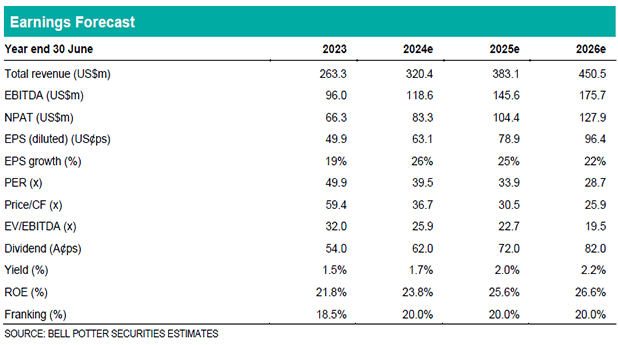

Altium reported an FY23 result consistent with both our forecasts and the guidance. Revenue increased 19% to US$263.3m (vs BPe US$261.0m and guidance US$255- 265m) and the statutory EBITDA margin improved from 36.2% in FY22 to 36.5% in FY23 (vs BPe 37.0% and guidance 35-37%). Operating cash flow was negatively impacted by a A$40m payment to the ATO in H2 though Altium is contesting the payment and expects to recover it in future periods. The final dividend of A29.0c was ahead of our forecast of A28.0c but there was no franking (vs BPe 40%).

Guidance in line or slightly below

Altium provided FY24 guidance of revenue b/w US$315-325m (vs BPe US$318m) and an EBITDA margin b/w 35-37% (vs BPe 38%). The company also reiterated its FY26 aspirational target of US$500m revenue (vs BPe US$448m) and a 38-40% EBITDA margin (vs BPe 40%). The company also reiterated the 100k subscriber target by FY26 but said the revenue could be achieved with only 75-90k seats on subscription.

Modest EPS downgrades

We have downgraded our EPS forecasts by c.1% in both FY24 and FY25. The downgrades have been driven by reductions in our margin estimates while our revenue forecasts are actually increased by c.1% in FY24 and FY25. Our FY26 revenue forecast is also modestly increased to US$450m but remains below the aspirational target. We assume no acquisitions in our forecasts.

Investment view: PT down 6% to $40.00, Maintain HOLD

With risk of a downgrade to the FY26 aspirational revenue target – in the absence of any acquisitions – we reduce the multiples we apply in the PE ratio and EV/EBITDA from 50x and 30x to 45x and 25x and also increase the WACC we apply in the DCF from 9.0% to 9.4%. This combined with the changes in our forecasts has resulted in a 6% decrease in our PT to A$40.00 which is <15% premium to the share price so we maintain our HOLD recommendation.