Quarterly highlights

The recent reporting season highlighted an inventory unwind in agricultural chemicals markets and strong pricing growth in competing products for NUF’s Omega-3 product.

Quarterly reporting and sector flows: 3Q23 revenues (AUD terms) in NUF core markets contracted -15% YOY, with signs of an inventory unwind in the supply chain (value of ag-chem imports down -20% YOY into NUF markets). Pricing outcomes were benign despite deteriorating active ingredient price. On the latter we note China glyphosate technical pricing has rallied ~40% from the lows.

Omega 3 pricing indicators: Omega 3 grade fishoil pricing rose +80% YOY to US$8,150/t, well ahead of the YOY uplift seen in Peruvian fishmeal. NUF competitor Corbion reported +135% YOY growth in its Algae Ingredients platform, with +34% YOY pricing growth in the quarter.

Seasonal drivers: Late harvest rainfall in the EU could be beneficial for late season insecticide demand. Australian winter crop production is forecast to fall -34% YOY and the area planted to summer crops is expected to fall -15% YOY. North America remains dry with the US crop condition trailing a year ago and 67% of the Canadian agricultural landscape is classified as abnormally dry.

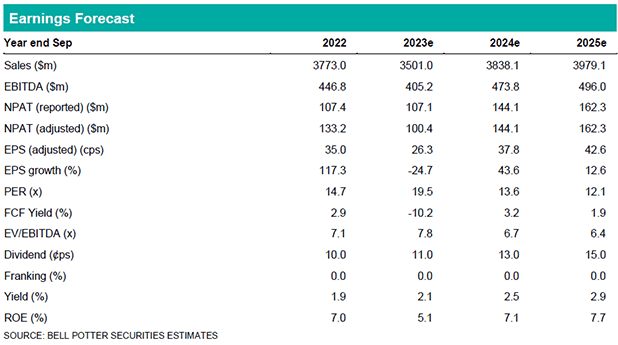

There are no changes to our forecasts in this report. We had previously downgraded our NUF forecasts (see: ”Peer pressure” (10/08/23)) to reflect softer sector wide 3Q23 sales trends. Our $7.00ps target price is also unchanged in this report.

Investment view: Buy rating unchanged

There is no change to our Buy rating. The late season in North America and inventory destocking in the channel appeared to be industry wide headwinds in 2QCY23e. However, a reversal of these trends in FY24e along with growth in the beyond yield program are likely to see a reasonable rebound in earnings in FY24e and lay the platform for growth in FY25-26e. The rapid price growth in omega-3 products is an ongoing positive development for potential market uptake of NUF’s Aquaterra product.