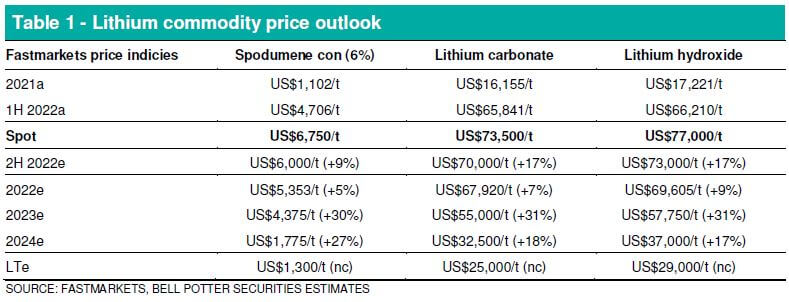

Lifting our near-term lithium pricing outlook

We have lifted our near-term lithium price outlook as outlined in the following table.

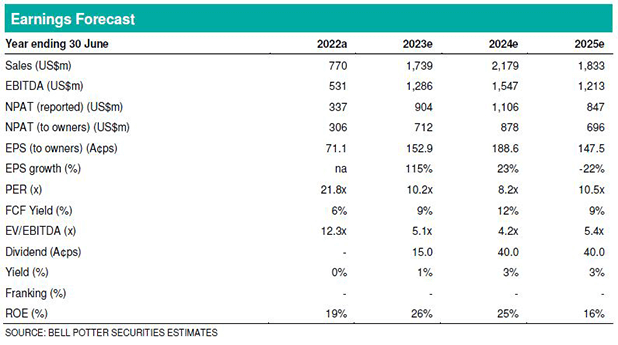

EPS changes as a result of these lithium commodity price upgrades are: FY23 +21%; FY24 +23%; and FY25 +2%.

Lithium: Demand outlook retained; supply constrained

We have updated our EV-led lithium demand model with no change to our bullish outlook; LCE demand to grow from around 0.5Mtpa in 2021 to over 1.1Mtpa in 2025 and around 3.0Mtpa in 2030. Supply analysis shows that over the next five years, Australian hard rock projects will at best meet only one third of this demand growth. We expect alternative sources of supply to remain relatively constrained and high-risk.

Investment view: Buy, TP$20.04/sh (prev $18.76/sh)

We expect AKE’s cash generation to lift substantially into 2023 with ongoing strength in lithium demand, commodity prices and production growth. AKE is aiming to maintain 10% share of supply in a global lithium market experiencing unprecedented growth; it has a portfolio of growth projects, balance sheet strength and cash flow from existing projects to achieve this. AKE’s portfolio is also diversified across lithium commodity, mode of production, asset location and end-user country.