Maiden FY21 result hits the mark

AIM has delivered a stronger than expected maiden full year result with an FY21 underlying EBITDA loss of ($3.1m) ahead of our ($4.1m) forecast. Revenue of $49.2m was 2% ahead of BPe ($48.2m) and up +28% on a pro-forma basis (+87% on a statutory basis). We note that the core business (excluding acquisitions) exceeded prospectus forecasts from both a revenue and EBITDA perspective by ~3% and ~8% respectively. The key driver of the beat was stronger than expected organic revenue growth despite currency headwinds.

Second half gross margin a real stand-out: The gross margin continued to expand in-line with expectations, up +2ppts to ~42% vs pcp but exited 2H21 closer to 45% which bodes well for further margin expansion into FY22. The pro-forma margin (inc. a 12-month contribution for EEG) which we deem a reasonable starting point for exit runrates was ~50%.

Cashflow and Balance sheet: AIM generated an operating cash outflow of $3.5m and exited 30 June with a $17.9m net cash position and no Company debt.

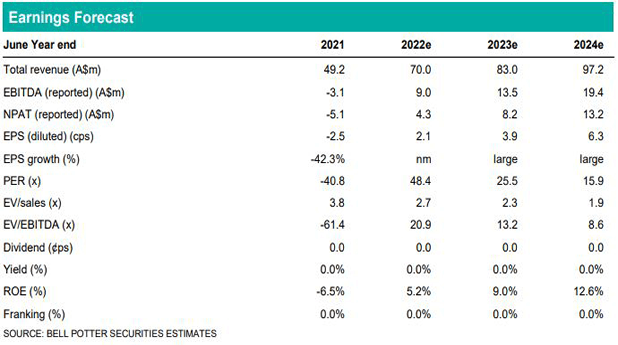

Changes to earnings: Management have not provided any formal earnings guidance for FY22 however they do expect strong revenue growth and margin expansion (both GM and EBITDA) to continue. Following the release of the FY21 result we have increased our gross margin assumptions, upgrading our underlying EBITDA forecasts by +19%, +12% and +9% across FY22e, FY23e and FY24e respectively. Broadly, these changes have had a negligible impact on EPS due to increased tax expense assumptions. Our $1.50ps PT remains unchanged.

Investment view: Maintain Buy recommendation

This result reflects an important milestone for management’s execution over the past 12-months but we now focus on how the Company is set up for a transformational year of growth in FY22. We continue to forecast margin expansion across all lines of the business through initiatives that have already been put in place and new growth initiatives. Ultimately we still see upside bias to our earnings forecasts.