Pro Forma results ahead of Prospectus forecast

DDH has delivered a strong maiden result as a listed company, with Pro Forma financial results in line with its Jul’21 update that was ahead of Prospectus estimates. Drilling revenues grew +17.3% YoY to $294.6m (BPe $294.2m), driven by ongoing drill rig fleet growth (+11.4% YoY), expanding utilisation (+320bps to 76.6%) and higher than forecast revenue per shift (FY21 $6,486 | Prospectus $6,395). EBITDA increased +15.8% YoY to $74.6m (BPe $74.8m), reflecting a slightly lower EBITDA margin (-46bps YoY) due to higher costs relating to COVID-19 impediments and labour. The final dividend was declared at 2.18¢ps ff (BPe $1.9¢ps). Other highlights include:

- FY21 utilisation implies strong 2H21e: FY21 utilisation of 76.6% (Prospectus 74.5%) implies 2H21 utilisation of ~79.5%, which was likely weighted to 4Q21. Momentum has continue into FY22e, with current utilisation in the “mid-80%s”.

- Set to deliver strong FY22 growth: DDH is set to deliver strong FY22e growth supported by the annualised contribution from the +10 rigs added to the fleet in FY21 and another +8 rigs that will be added to the fleet in FY22 (+7 to delivered by Dec’21).

- Rates forecast to increase: Rates are forecast to increase in FY22e due to high demand, constrained rig supply, and tight labour. ~10-12 month lead times on new rigs will limit the speed of a supply response, supporting utilisation and rates in our view.

- Cost pressures moderate margin expectations: COVID-19 impediments and labour related cost inflation is moderating margin expectations. However, we still expect higher utilisation and rates to drive higher gross profit and EBITDA per average rig.

Investment view: Retain Buy recommendation

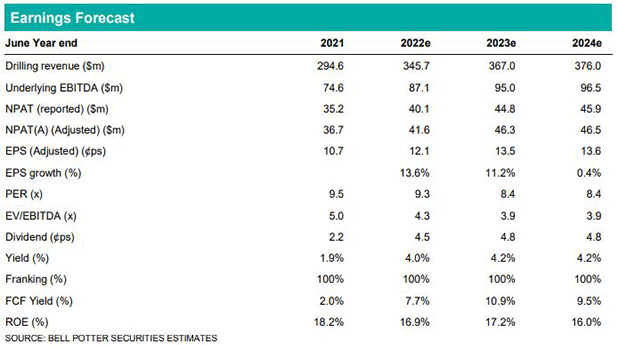

We have marginally increased our Underlying EPS estimates by +0.2%, +0.3%, with higher revenue forecasts offset by higher cost assumptions. We expect ongoing rig fleet growth to drive FY22e earnings growth, while tight demand and supply conditions present upside risk to our utilisation and rate assumptions. Ongoing east coast lockdowns presents near-term operational challenges (QLD:WA border is most important), although we expect strong operating leverage as conditions normalise. We reiterate our Buy recommendation, with a $1.48ps Price Target (previously $1.45ps).