Copper exploration success could see production +30ktpa

AIS has announced drilling and exploration results from its Avoca Tank underground mine, within its 100%-owned Tritton Copper Operations. Avoca Tank has a Reserve of 700kt at 2.5% Cu for 18kt contained Cu and is currently the highest grade (but also the smallest) known deposit on the Tritton tenement package. Preliminary results from the current drill program, designed to test for depth extensions, have returned positive visual results, intersecting mineralised sulphide lenses 75m below the current known Resource. Should the Resource at Avoca Tank continue to grow, we can see that in combination with the sulphide portion of the newly discovered Constellation deposit, head grades of 2.0% Cu or higher could be achieved through FY25. At the current mill throughput rate this would imply peak copper production from Tritton of +30ktpa.

+10 year mine life potential being overlooked

The exploration success and development of new production sources at Tritton is driving a widening gap between the mine life as it is being valued by the market and the mine life extension potential we see emerging. In our view, it is reasonable to consider the current combined Ore Reserves and Mineral Resources of 11.0Mt as a conservative representation of the Mining Inventory at Tritton. Moreover, allowing for the low end of the Exploration Target at Constellation (+6Mt) and for modest (20%) growth at the Tritton, Budgerygar and Avoca Tank deposits (+1Mt combined) implies a Mining Inventory of 18Mt, which would support a mine life of +11 years.

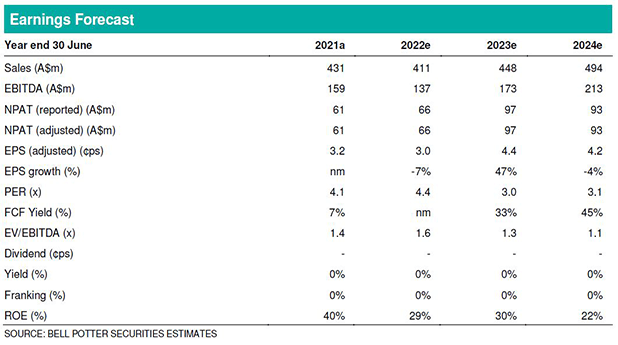

Investment thesis – Buy, TP $0.21/sh (from Buy, $0.22/sh)

In our view, AIS’ 3.0-4.0x P/E multiples signal that the market is pricing in a 4-5 year mine life. This significantly discounts what we view as a conservative ~7 year mine life outlook and in excess of 10 years when allowing for likely exploration success. That discount looks even greater in the context of what we expect to be a production profile rising towards ~25ktpa and potentially peaking above 30ktpa. AIS appears overlooked by the market and extremely good value at these levels. We trim our FY23 earnings forecast 16% on a lower production contribution from the Tritton underground. Buy.