Six more weeks of winter

SM1 have downwardly revised FY23e NPAT expectations relative to market expectations ahead of its 1H23e result. Key points below:

NPAT guidance statements: FY23e NPAT is forecast at NZ$15-25m, which is lower than our previous NZ$35.8m forecast (and consensus of ~NZ$50m). Major drivers of the changes to expectations have been listed as order deferrals from major IMF customers, inflationary cost pressures, lower milk production levels and higher working capital funding costs. SM1 has also stated that the two year recovery plan is likely to now take three years, implying a lower FY23e exit rate than previously suggested (previous guidance was for a FY23e exit run rate more consistent with profitability levels pre-FY21), reflecting elevated costs and reduced customer demand.

Nutritionals: Our previous forecasts had implied limited demand growth from A2M in FY23e (we note A2M FY23e revenue guidance was unchanged in Feb’22), with low-mid single digit volume growth in FY24-25e assuming SAMR registration and a resumption of growth in China distribution points. These estimates remain broadly unchanged. However, we have moderated assumed volume ramp-up profiles for both the new Pokeno and new base powder customers.

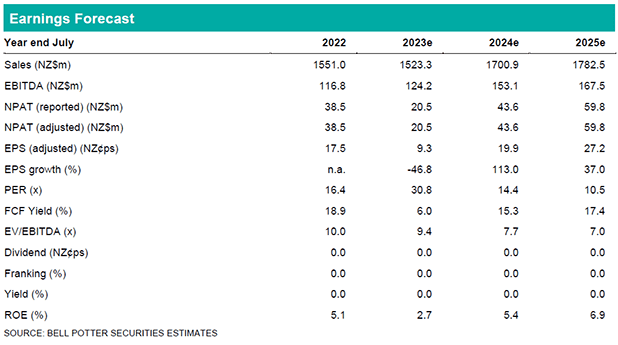

Following the update we have downgraded our EBITDA forecasts by -11% in FY23e, -12% in FY24e and -11% in FY25e. This along with a higher funding cost to carry working capital, results in NPAT downgrades of -43% in FY23e, -33% in FY24e and -22% in FY25e. Our target price is downgraded to A$3.20ps (prev. A$4.00ps) following these changes.

Investment view: Buy rating unchanged

SM1 has now been imbedded in a three year earnings downgrade cycle and is not without risk. However, if it can deliver acceptable returns on the new Pokeno nutritionals customer, successfully navigate A2M’s new-GB registration and add new base powder customers then there is material operating leverage beyond FY23e profitability levels and this is what drives the expected earnings uplift in FY24-25e.