H1 guidance consistent with our forecasts

Eagers Automotive released a trading update and provided 1H2022 guidance of underlying operating PBT b/w $183-189m which is 12-15% below the pcp on a like-forlike basis (i.e. excluding the Daimler Trucks contribution in 1H2021). The company noted that demand for new vehicles continues to materially exceed supply and as a result the new car order book has increased by >25% since 31 December 2021. It also said new car margins have remained in line with the very strong levels of 2021 but an anticipated reduction in the number of new vehicles delivered to customers in 1H2022 is driving the forecast reduction in profit versus the pcp. Eagers also added it is well positioned to deliver a strong second half performance subject to supply constraints easing.

No change in underlying forecasts

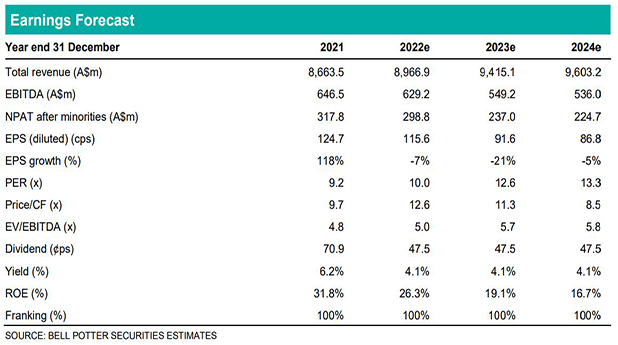

There is no change in our underlying forecasts in 2022, 2023 and 2024. We continue to forecast underlying operating PBT of $381m in 2022 which is split $192m/190m in H1/H2. That is, we forecast a slightly higher result than the guidance in H1 and then forecast a similar result in H2 given our view that supply constraints are unlikely to ease materially in the short term. We then continue to forecast a decline in underlying operating PBT to $339m in 2023 and $326m in 2024 as supply constraints ease and, as a result, margins decline. But we also note that due to the strength in the order book, there is some upside risk to at least our 2023 forecasts as the margins will remain strong for a period until the backlog of orders is mostly cleared.

Investment view: PT down 10% to $15.50, Maintain BUY

While there is no change in our underlying forecasts we have updated each valuation used in the determination of our price target for market movements and time creep. There are no changes in the key assumptions we apply in the valuations. The net result is a 10% decrease in our PT to $15.50 which has all been driven by a reduction in the relative valuations. At this PT the total expected return is >30% so we retain our BUY recommendation.