Is there value in fixed income?

The combination of a hawkish Federal Reserve and a developing conflict between Russia and Ukraine has elevated commodity prices, recalibrated interest rate expectations and spiralled financial markets.

Given that inflation is mathematically defined as the persistent increase in the price level over time (rate of change), a singular jump does not mean that an economy is experiencing inflation. An increase in the price of a single good/service, or in relative prices of some goods/services, does not signal that inflation is present either. The prices of almost all goods and services must be increasing. We believe that this is unsustainable, particularly as central banks begin to destroy aggregate demand. The forward looking bond markets have been pricing in aggressive rate hikes, producing a harsh and protracted sell-off as the present value of a bond’s payments, or its market value, decrease as bond yields increase. Central banks, especially Australia, have been far behind on yield curve control. Add to this the fact that our wage push is lagging, plus funding costs would increase at a time when the economy sits as highly levered. Investment Grade bonds then begin to look reasonably attractive from a longer-term investment horizon.

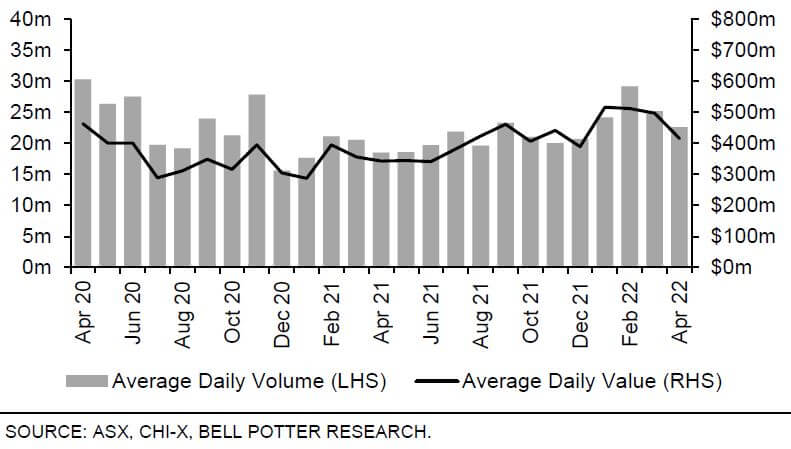

Figure 1 – Comparison of trading days from index high

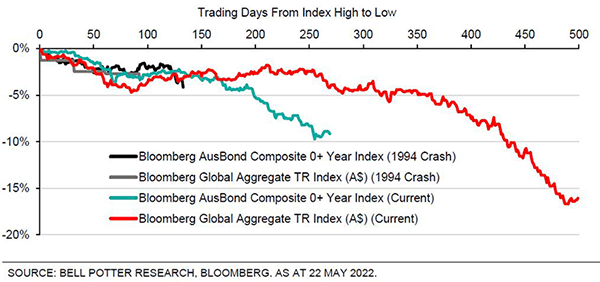

Figure 2 – Top ETF flows for April 2022

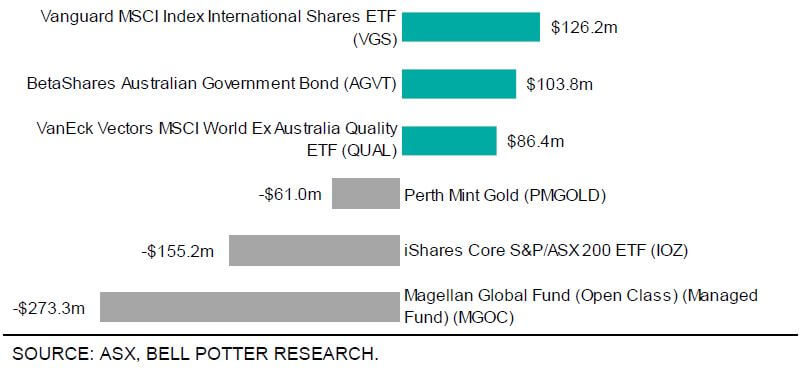

Figure 3 – Top ETF flows for 12 months ending April 2022

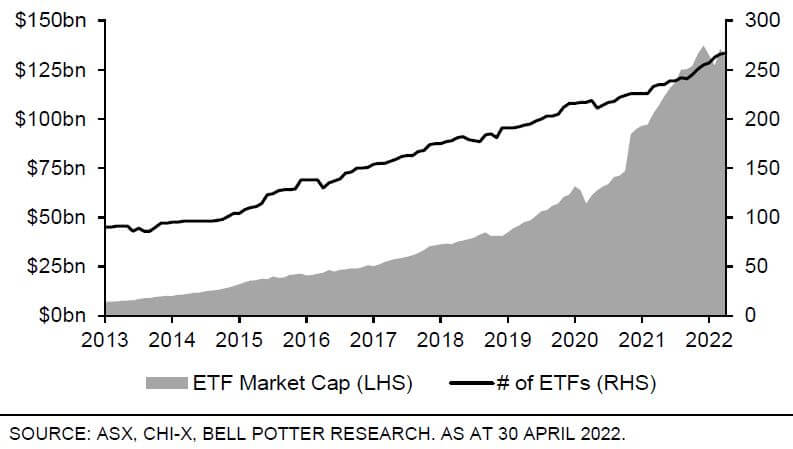

Figure 4 – ETF market size

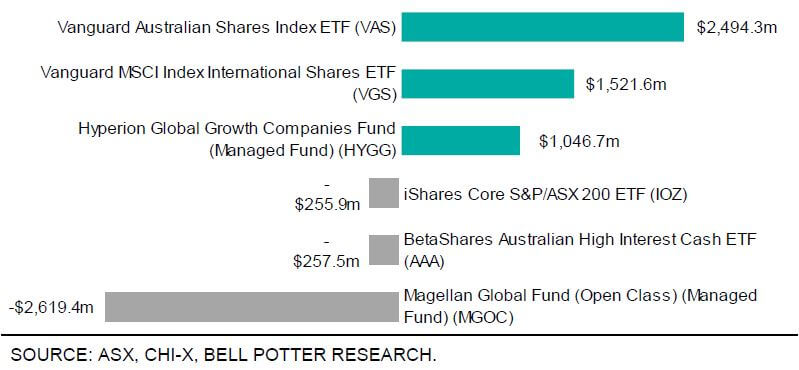

Figure 5 – Average daily volume and value