A core-satellite approach to investing

Traditional broad market indices, by nature of their composition, are backwards looking and skew the significance to companies with greater relative market capitalisation. Therefore on a forward looking basis, investors may be underexposed to benefit from future disruptors and beneficiaries of secular growth.

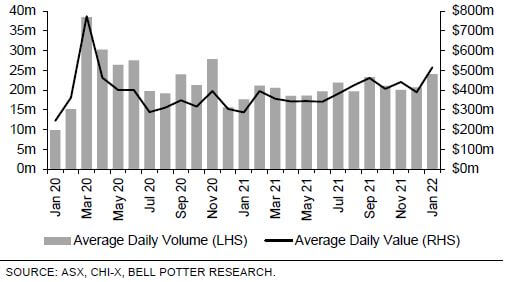

The S&P Global Technology Index (in AUD) has returned a cumulative 249.0% in the last 5 years, with Information Technology now constituting 28.7% of the S&P 500 Index’s taxonomy (as at 31 January 2022). The cyclicality of commodity prices, meanwhile, has led to a decline in index relevance from 20.1% to 5.9%, as measured from the peak in early 2008 to date, for both the Energy and Materials sectors combined.

The purpose of this example is not to state the obvious in hindsight, but rather, to highlight the fact that future drivers of growth and earnings that underpin business models must be considered when future proofing portfolios.

Figure 1 – S&P 500 index composition

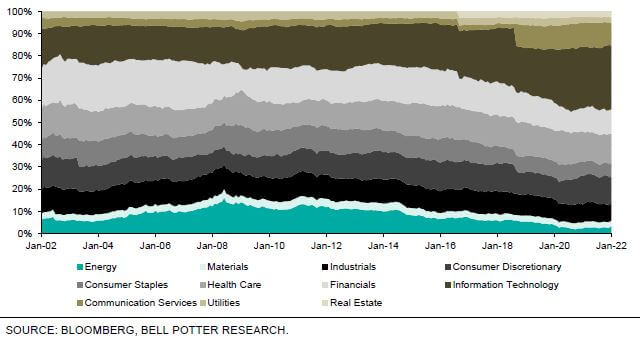

Figure 2 – Top ETF flows for January 2022

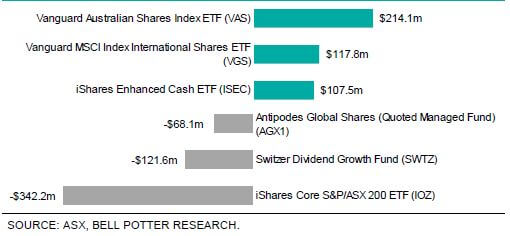

Figure 3 – Top ETF flows for 12 months ending January 2022

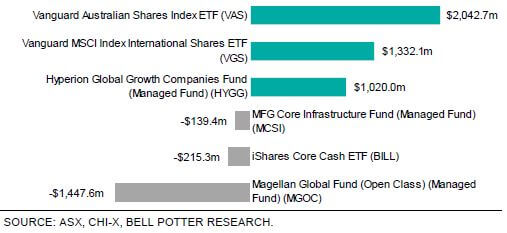

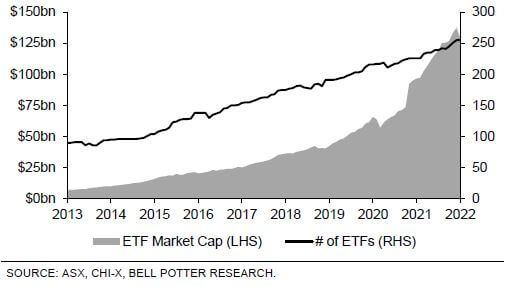

Figure 4 – ETF market size

Figure 5 – Average daily volume and value