Result ahead of forecast and guidance

Underlying PBT of $401.8m was ahead of our forecast of $394.6m and the guidance of $390-395m. The beat was driven by a higher PBT margin than we were forecasting (4.7% vs BP 4.4%) which was only partially offset by lower revenue than we were forecasting ($8,861m vs BP $8,974m). Operating cash flow was good but down on pcp due to the absence of JobKeeper payments ($133m) and higher tax paid ($131m vs $84m). Net corporate debt at the end of 2020 was $128.4m which was down slightly from $129.3m at the end of 2020. Positive surprise was a large increase in the final dividend to 42.5c whereas we were forecasting a flat final dividend of 25.0c.

No guidance but none expected

Eagers did not provide 2022 guidance but it is not the company’s policy to do so. The company did say, however, that “despite the ongoing supply chain constraints and temporary disruption to logistics and resourcing experienced in early 2022 as a result of the Omicron outbreak, unusually strong demand continues in all regions across both Australia and New Zealand”.

Negligible change in PBT forecasts

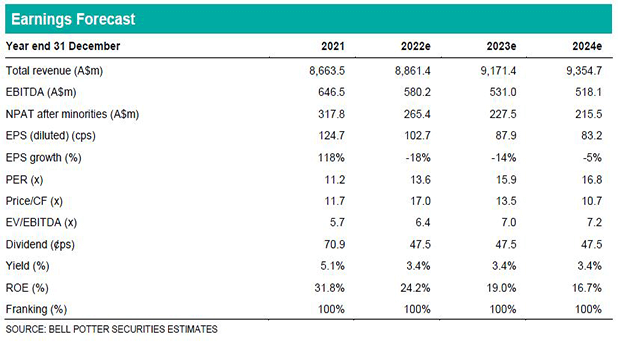

There is negligible change in our underlying PBT forecasts in 2022 and 2023. We have, however, reduced our revenue forecasts by 5% and 3% due to the ongoing supply chain constraints. This however has been offset by increases in our PBT margin forecasts which are now 4.3% and 3.6%. We continue to forecast underlying PBT of c.$375m in 2022 and c.$325m in 2023.

Investment view: PT down 3% to $17.25, Maintain BUY

We have updated each valuation used in the determination of our price target for the modest changes in our forecasts as well as market movements and time creep. We have also removed the discount previously applied in the relative valuations. The net result is a 3% decrease in our PT to $17.25 which is >15% premium to the share price so we maintain our BUY recommendation.