Quarterly preview: Pricing to overwhelm weaker production

We expect another weak quarter of production with Maules Creek output curtailed and a scheduled longwall change at Narrabri. However, the coal price strength from mid2021 should now be flowing through to realised prices, materially lifting free cash flow. Quarter-on-quarter average index prices have again lifted to record highs, Maules Creek production will rebound from early 2022 and Narrabri will de-risk over the coming year, all supporting significant free cash flow generation, an imminent return to a net cash position and the prospect of shareholder returns.

Chasing coal prices higher

We have marked-to-market coal prices for the December 2021 quarter and lifted our thermal coal price outlook to average US$135/t in 2022, up 20% on our prior estimate. Spot thermal coal prices are currently US$197/t.

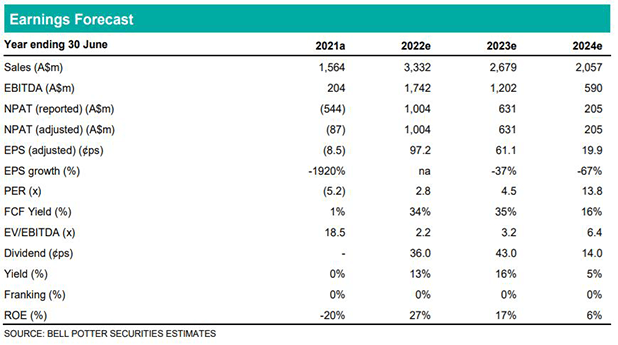

EPS changes in this report are: FY22 +30%; FY23 +13%; and FY24 +2%.

Our coal outlook favours an overweight met coal position. Thermal coal’s recent price strength appears more driven by transitory factors with a higher propensity to unwind over the coming quarters. Met coal’s supply-demand fundamentals look more robust, with a significant role in infrastructure-led stimulus and new supply constrained.

Investment view: Buy (prev. Hold), Target Price $3.60/sh

Record thermal coal prices over recent quarters will support WHC’s rapid de-gearing and ultimately a significant cash position and reinstatement of shareholder returns. Operational risks at Narrabri remain, however, should abate over 2022 as mining transitions to shallower panels in FY23. WHC is cheap on most valuation metrics, supporting our upgrade to a Buy recommendation. The caveats to our position are the potential for thermal coal price strength to unwind over the coming quarters and that thermal coal is increasingly excluded from fund managers’ investment mandates.