No change in forecasts

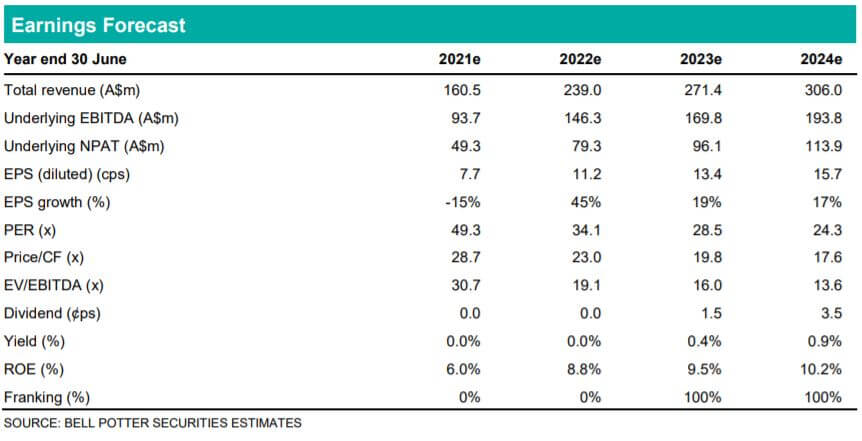

There is no change in our forecasts which we last updated just over a month ago at the release of the FY21 result. We continue to forecast underlying EBITDA of $146.3m in FY22 which equates to strong growth of 56% and is driven by a mix of organic growth and full 12 month contributions from acquisitions completed in 1HFY21 (i.e. Opticomm, Telstra Velocity and Harbour ISP). We then forecast continued strong growth in underlying EBITDA of 16% in FY23 which is all organic (i.e. we assume no more acquisitions in our forecasts). Note we do not forecast any capital management initiatives in our short to medium term forecasts (i.e. dividends or share buybacks) though the company has flagged this is under consideration.

Investment view: $4.50 PT unchanged, Upgrade to BUY

There is similarly no change in our PT of $4.50 given the lack of change in our forecasts and we also only updated it in late August. At this PT the total expected return is >15% so we upgrade our recommendation from HOLD to BUY. (Note the TER includes any forecast dividend yield but, as mentioned, we do not forecast any dividends in FY22 though there is potential for some.) We see the recent pullback in the share price below $4.00 as a buying opportunity given the outlook is unchanged and one reason for the pullback – the charging of director Vaughan Bowen for insider trading – does not in our view have any material impact on the company.

More positives than negatives

In our view the potential positive catalysts for Uniti over the next several months far outweigh the potential negatives from the charging of Vaughan Bowen. The potential catalysts include a strong trading update at the AGM in November, an announcement on capital management, a strong 1HFY22 result in February and perhaps even a takeover offer (given we believe Uniti is a target). The potential negatives are some customers cancel their services – something we believe the company is watching closely but has yet to occur – and some shareholders with a strong ESG bias decide to sell (a lack of industry super funds on the register suggest the risk of this is low).