No change in forecasts

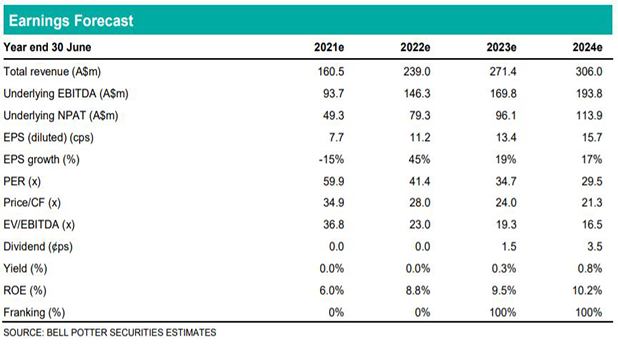

There is no change in our forecasts for Uniti which we last updated at the release of the FY21 result in August. We continue to forecast underlying EBITDA of $146.3m in FY22 which equates to strong growth of 56% and is driven by a mix of organic growth and full 12 month contributions from acquisitions completed in 1HFY21 (i.e. Opticomm, Telstra Velocity and Harbour ISP). We note our forecast is slightly above the consensus forecast of $144.5m which the company said it is “on track to meet or exceed” when it provided an operational update in mid November. We then forecast continued strong growth in underlying EBITDA of 16% in FY23 which is all organic (i.e. we assume no more acquisitions in our forecasts). Note we do not assume any shares are bought back under the recently announced share buy-back in our forecasts and wait for this to commence before looking to make any adjustments.

6% increase in PT to $4.75

While there is no change in our forecasts we have updated each valuation used in the determination of our price target for market movements and time creep. We have also increased the multiple applied in our EV/EBITDA valuation from 20x to 22x given the strong share price performance of Aussie Broadband (ABB), the likely material debt reduction in 1HFY22 beyond the $25m already announced in the operational update and/or a commencement of the share buy-back. The net result is a 6% increase in our PT to $4.75 which has mostly been driven by an increase in the EV/EBITDA valuation.

Investment view: Downgrade to HOLD

At our updated PT of $4.75 the total expected return is only 2% so we downgrade our recommendation from BUY to HOLD. The key risks to our downgrade are, firstly, a better than expected 1HFY22 result though the operational update suggests the company is on track to do slightly better than consensus but not significantly better. Secondly, a bid for the company and while we view this as likely at some stage there is no certainty it will occur. And thirdly, a market shift towards more defensive or infrastructure based stocks which we are perhaps already seeing.