Trading ideas and managing risk

A portfolio is not a set and forget outcome. Once constructed and adequately tailored, a portfolio will need to be monitored and reviewed at regular intervals, with the composition revised. The result of market movements may mean that security analysis changes due to changes in security prices and fundamental factors. Additionally, asset weightings may have drifted from their intended levels due to market movements. The portfolio may also need to be revised if it becomes apparent that the client’s needs or circumstances have changed. Regardless, portfolio rebalancing will be required in order to achieve the targeted risk-and-return characteristics.

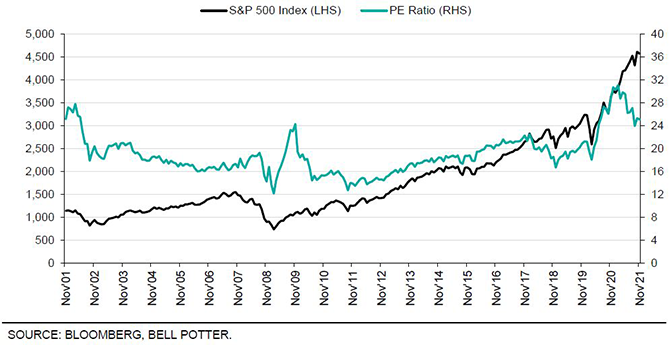

In theory, investors select a rebalancing strategy that weighs their willingness to assume risk against expected returns net of the cost of rebalancing. Given exceptional returns and all-time-new-highs for the S&P 500 Index, now is the time to reconsider your international equities allocation and how to stay fully invested while managing downside risk (continued on pages 2-5).

Figure 1 – A look at US equities

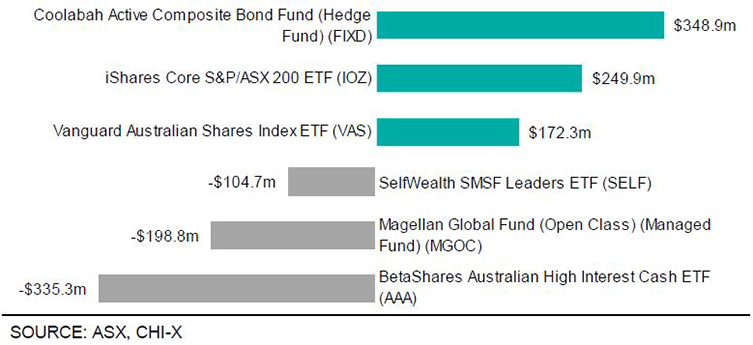

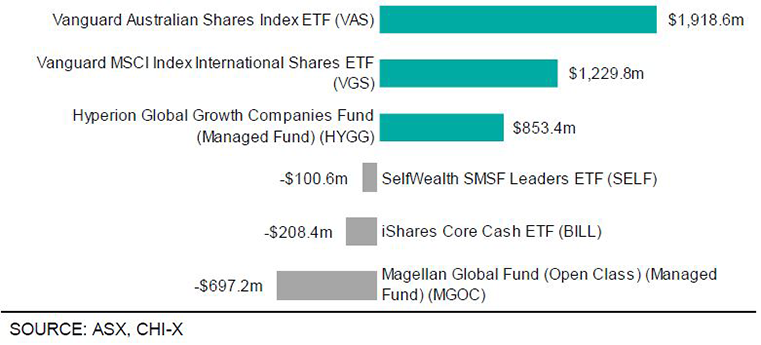

Figure 2 – Top ETF flows for November 2021

Figure 3 – Top ETF flows for 12 months ending November 2021

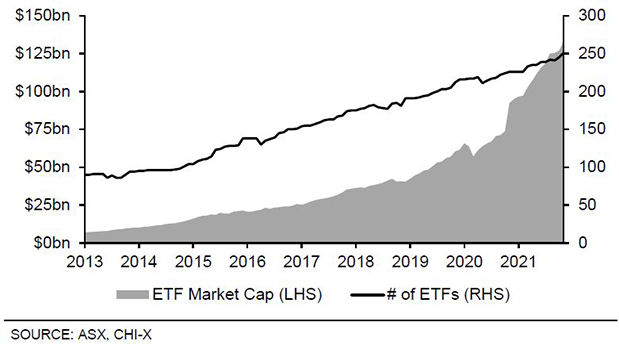

Figure 4 – ETF market size

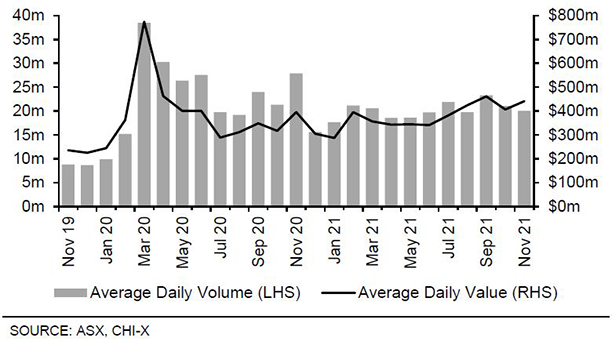

Figure 5 – Average daily volume and value