Earnings growth outlook

The Mobile and Infrastructure businesses of Telstra together generated c.92% of underlying EBITDA in FY23 (note Infrastructure includes International, InfraCo Fixed and Amplitel). In our view this is a good thing as Mobile is growing (the company’s aim is mid-single digit growth in service revenue to FY25) and Infrastructure is underpinned by an average 24 year contracted period with nbn (which includes annual CPI adjustments). The remaining c.8% of underlying EBITDA was generated by the Fixed business and while there are headwinds in this area – most notably in Enterprise – the contribution is not large enough to cause a significant drag on earnings. The overall outlook, therefore, is continued growth over the short to medium term and the guidance for underlying EBITDA is mid-single digit CAGR between FY21 and FY25.

Dividends also expected to grow

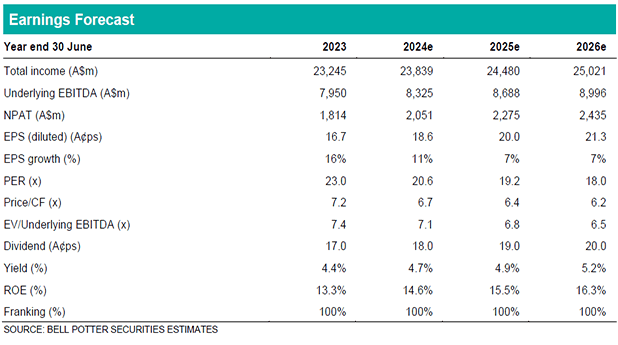

Our underlying EBITDA forecast of $8.3bn in FY24 is consistent with the guidance of $8.2-8.4bn and our forecast CAGR in underlying EBITDA between FY21 and FY25 is 6.8%. Our forecast CAGR in underlying EPS between FY21 and FY25 is much higher

at 20.2% but note this is generally consistent with the guidance of “high teens”. Telstra has said it aims to “maximise” the fully-franked dividend and “grow” it over time. On the back of these statements and the expected growth in EPS we forecast the fully franked dividend to increase from 17.0c in FY23 to 18.0c in FY24 and 19.0c in FY25.

Investment view: $4.15 PT, Initiate with HOLD

Our price target for Telstra is $4.15 which is determined through a blend of four valuations: PE ratio, DCF, DDM and SOTP. This PT is a modest premium to the share price and, combined with the forecast yield of 4.7%, equates a total expected return of 12.8%. This is less than the required 15% or more for a BUY so we initiate with a HOLD recommendation. In our view the stock looks fairly valued on an FY24 PE ratio of c.21x with CAGR in underlying EPS between FY21 and FY25 in the high teens. Notably, the forecast yield of 4.7% is not dissimilar to current six to twelve month term deposit rates though the dividend is fully franked.