Softening the A2M recovery trajectory

A2M provided updated FY21e earnings guidance, which projected a slower recovery in 4Q21e than expected and the potential for this to drag into 1Q22e. In light of this we softened the trajectory of the rebound in A2M volumes impacting our SM1 assumptions. Key points below:

A2M FY21e guidance downgrade: FY21e revenue guidance has been downgraded from NZ$1.4Bn to NZ$1.20-1.25Bn and EBITDA margin guidance downgraded to 11- 12% from 24-26%. Revised guidance includes NZ$80-90m in inventory impairments (on top of NZ$23m taken in 1H21) and NZ$8m in expensing of a new ERP system. Underlying FY21e EBITDA looks closer to NZ$243-271m or a margin of 20-22%.

Inventory management: A2M will move to an inventory swap with key customers to remove aged stock from the supply chain. At the same time A2M will continue to supply lower levels of volume into the channel, on balance we do not expect a material deviation from our previous FY21e SM1 volume expectations, though would expect a softer recovery in FY22-23e volumes. We would expect SM1 sales to more closely align with A2M volumes in FY22-23e.

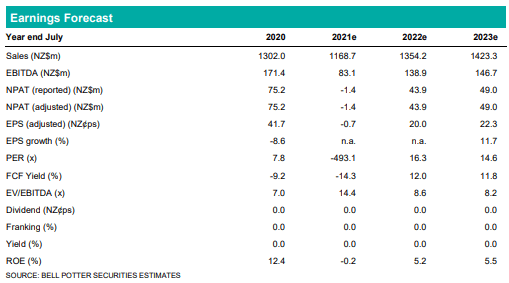

Following changes to our A2M forecasts we have downgraded EBITDA forecasts by 7% in FY22e and 6% in FY23e. This results in NPAT downgrades of 14% in FY22e and 13% in FY23e. Our target price is downgraded to A$3.85ps (prev. A$4.10ps) following these changes.

Investment view: Retain Buy rating

FY21e ROIC (particularly 2H21e) is reflective of a business that has completed the commissioning of major capital works while experiencing an unfavourable shift in sales mix. As SM1 moves from the commissioning to product mix optimisation of the asset lifecycle, we would expect a material recovery in earnings and ROIC. We are cognisant of the potential risk in FY24e around A2M English label IMF supply, however see moves to de-risk key customer exposure at Pokeno and through investments in Dairyworks and liquids as reducing the downside to future earnings and cashflow.