Key figures (Solvar was formerly Money3)

Overall this was a good set of figures showing a 13.1 increase in gross loans, and top line growth of 13.5% in revenue, with EBITDA up 16.2% to $56.7m and above expectations. The fully franked dividend grew 25% to 7.5cps.

There was no sign of worsening stress in credit quality, and the net profit grew, despite an increase in bad debts (rising at 7%) and increased interest costs. These figures could have been worse given the impact of rising rates on the economy. The lowering of NPAT guidance to $48.0m (from $52.0m at AGM in November) is disappointing but attributed to higher funding costs and recent flooding in NZ.

Investment View: target price $3.01/ share

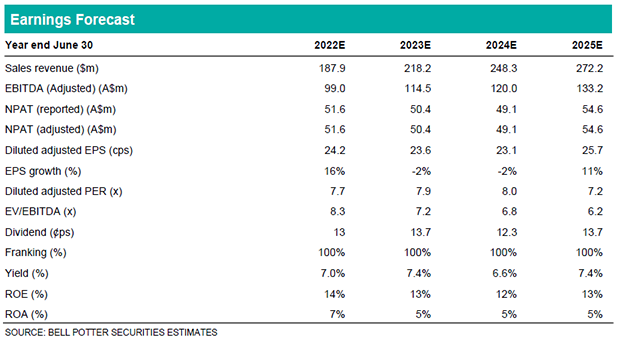

We have reviewed our assumptions and forecasts with the revised guidance. We have decreased the growth rate in the loan book in FY23 (from $968m to $896m) and lowered our modelled net interest margin by 1% (to 21.0% in FY23 and to 20.1% in FY24), to reflect the increased funding cost. Our earnings estimates fall by 8.5% in FY23, 10.1% in FY24 and 12.6% in FY25, reflecting the higher funding cost and slower loan growth.

Our valuation rises though as SVR replaces expensive equity, with relatively cheaper debt in the funding mix. We value SVR at $3.01 per share ($2.90 previously) share using a NPV based approach, and our recommendation remains BUY.

It may be tempting for investors to dismiss this high price target as based upon assumptions that are far too optimistic, but we would make the following points: this company is highly profitable making very high margins and tapping into a large potential market. While the economy may slow, the company is good at managing its customers and collecting cash. The company will increase the debt backing of its loan book, which should increase the RoE, and allow shareholder capital to be released, enhancing cash generation, and ultimately dividends.