March 2022 quarterly report

RRL has reported March 2022 quarterly production of 103.1koz at AISC of A$1,574/oz. The result compared with our forecast of 113.9koz at AISC of A$1,491/oz and guidance of 112koz at AISC of A$1,465/oz. We had been looking for an improved quarterly production and cost performance, consistent with company guidance that production would be weighted to 2HFY22. Both the Duketon and Tropicana operations missed our estimates. At Duketon, production was steady at 74.8koz at AISC of A$1,670/oz (vs BPe 80.9koz at A$1,593/oz). At Tropicana, grades dropped 15% qoq, for production attributable to RRL of 28.3koz at AISC of A$1,216/oz (vs BPe 33.0koz at A$1,131/oz). Gold sales of $172m from 76.0koz (just 74% of gold production) were impacted by a build-up of gold-in-circuit and resulted in forward sales of 25koz at A$1,571/oz representing 33% of gold sales for the quarter. At quarter-end, RRL held cash and bullion of $167m (from $180m qoq) and drawn debt of $300m.

Down, but not out

The possibility of improved production and costs is now pushed back into the final quarter of FY22 and RRL looks likely to be heading for the low end of its (previously lowered) production guidance range and will be doing well to meet guided AISC. While this is disappointing for FY22, it is not, as yet, putting RRL’s A$300m debt repayment (maturing end FY24) in jeopardy or otherwise putting pressure on the balance sheet. This is contingent on significant production growth at both operations (BPe ~500kozpa for FY23 and FY24) and we will need to see progress towards this in FY23. Costs and margins remain competitive with the sector and there is significant opportunity for organic growth to deliver a material re-rating, but RRL needs to deliver.

Investment thesis – Buy, TP $3.00/sh (from $3.15/sh)

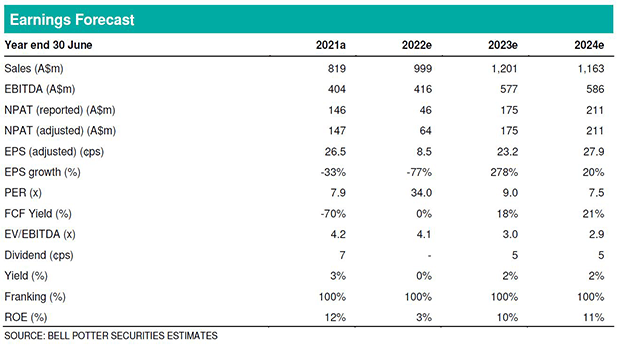

We retain the view that on a risk-reward basis, RRL, with two long-life assets, is still attractive. Our FY22 earnings forecast is cut 24%, on higher costs and lower production. FY23 and FY24 earnings are cut 7% and 13% respectively, on higher costs. We maintain our Buy recommendation on a 5% lower target price of $3.00/sh.