63koz bought back for $98m

RRL has announced the closure of its gold hedge book for a cost of A$98m. The closure comprised the buyback of 63,000oz forward sold at a gold price of A$1,571/oz, for delivery over the balance of FY24 at a rate of 10koz per month / 30koz per quarter. We calculate that for the December 2023 quarter RRL has delivered 27koz. This was its final hedge book delivery and as of 11 December 2023 RRL is fully unhedged, with all sales now exposed to spot gold prices. The closure has been funded from existing cash reserves, last reported to be A$250m at end September 2023.

Increased investor appeal, valuation multiple expansion

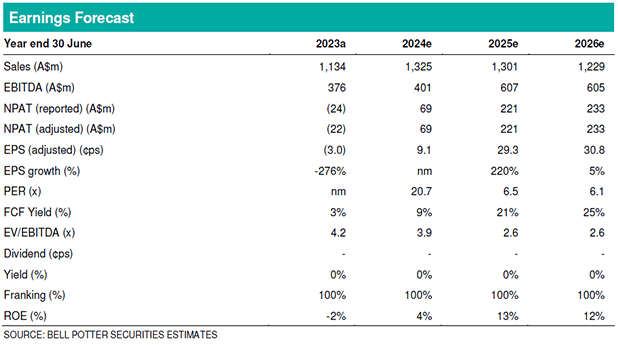

While this move has been signalled to the market, its implementation is a significant milestone for the company and results in forecast earnings upgrades for FY24, offset by the expense of the closure, which we record above the EBITDA line. We calculate a

net closure price of ~A$3,120/oz, with the implication being that if the A$ gold price is above that level through FY24, RRL will come out ahead of its $98m outlay. More important, however, is RRL’s operating margin expansion, its appeal to investors seeking unhedged gold exposure in a rising gold price environment and the increase in quarterly cash flow generation metrics that the market gives a strong weighting to in its valuation of gold producers. RRL has been heavily discounted on this metric, largely

due to its hedge book. We expect this event to bring forward a re-rating of RRL’s share price from mid-CY24 to the next couple of quarters, as its results are reported.

Investment thesis – Buy, TP $2.37/sh (from Buy, TP$2.31/sh)

Earnings changes in this report are: FY24: +9%; FY25: +1% and FY26: +2%. RRL is one of the largest ASX gold producers with an attractive all-Australian asset portfolio and organic growth options which are unique at this scale. It now offers full exposure to the gold price and strong free cash flow growth over FY24 and FY25. These attributes also make RRL an appealing corporate target in the current M&A environment. Our NPV-based valuation is up 3%, to $2.37/sh and we retain our Buy recommendation.