Acquisitions – PFP to enter Adelaide & expand in Auckland

PFP announced it has executed binding sale agreements to acquire: 1) Berry Funeral Directors – fourth generation family business since 1934 located in Norwood, Adelaide; 2) Glenelg Funerals – operating for >25 years located in Glenelg, Adelaide; & 3) State of Grace – operates from two locations in Auckland. Together, the businesses conduct ~1,200 funerals per annum and generated ~$9.0m in their most recent financial year. Total consideration is up to $17.6m and includes an upfront payment of $15.2m in cash + $0.2m in PFP shares escrowed for up to 3 years + earn-out of up to ~$2.2m in cash over 3 years. Expected completion of the proposed acquisitions is by 31 Dec’21.

We believe the acquisitions are attractive, as follows:

- Marks entry into Adelaide, a new fragmented metropolitan market for PFP: The acquisition of Berry Funeral Directors (amongst the market leaders in metro Adelaide) and Glenelg Funerals, mark PFP’s entry into Adelaide while providing a strong platform to pursue further growth opportunities. Adelaide metro is a highly fragmented market, and therefore we see potential for further consolidation.

- Expands PFP’s footprint in Auckland: The acquisition of State of Grace (west Auckland) further expands PFP’s presence in Auckland, nicely complementing Dils Groups (north Auckland) and Davis Funerals (throughout Auckland).

- Timely ahead of normalisation of death volumes: Market volumes have been tracking below long-term trends. This will normalise at some point, with potential to ‘overshoot’. These acquisitions strengthen PFP’s market position ahead of this.

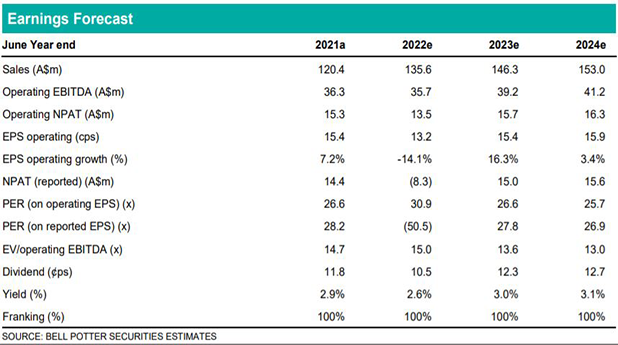

Earnings changes & Investment view: Retain Buy, PT $4.65

We assume the businesses being acquired operate at an average EBITDA margin of ~25%, implying an EV/EBITDA purchase multiple of ~7.8x. Including the acquisitions based on this assumption results in FY22/FY23/FY24 EPS upgrades of +4.5%/+7.5%/+7.7% and our 12-month price target increases to $4.65 (previously $4.25). Based on further acquisition prospects (noting PFP’s does not yet have a presence in Sydney metro, Melbourne metro, Wellington or Christchurch), an expected normalisation in volumes and opex leverage benefits this will provide, we retain our Buy rating.