Executing in the regional portfolio

Propel Funeral Partners (PFP) announced three acquisitions in regional Australia/New Zealand at A$10.6m (cash/script based) today and an upsizing of funding facilities. While these are new markets for PFP, the company will also acquire freehold property in these new businesses and the existing PFP business including a cremation facility in regional NZ which we think would drive margin expansion on improving revenues from acquisitions over time. We see PFP growing their market share towards ~11% (Aus, BPe) in comparison to market leader, Invocare’s market share of ~22% in 1Q23.

Earnings changes

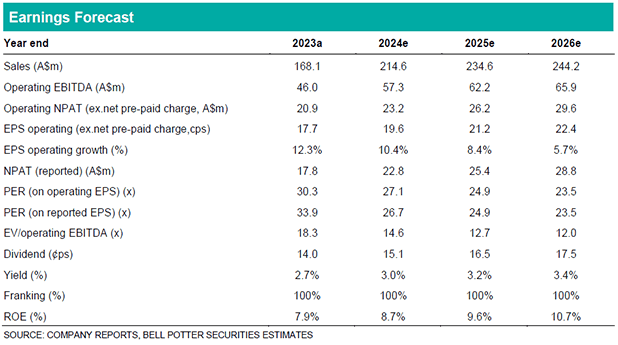

We factor in the acquisitions announced today where we forecast a 3-month contribution in FY24e and $5m annualised revenues in FY25e. On the back of the full year contribution in FY25e, we estimate a ~2% incremental contribution to our forward revenues and ~1% accretion to NPAT, in line with the company’s expectations for earnings accretion in year 1. We also account for minor scale benefits in the operating cost line over the longer term given PFP’s market share of ~11% that we estimate with the recent acquisitions annualised. The net result sees our NPAT forecasts +0.1%/+1.1%/+0.8% for FY24/25/26e.

Investment View: PT up 3.5% to $5.90, Maintain BUY

Our Price Target increases 3.5% to $5.90/share driven by our medium-longer-term earnings changes. We continue to view PFP’s growth as well supported by a strong underlying business with good pricing power in addition to its acquisitive strategy in a large and fragmented market. We expect organic volume growth to return in 2Q24 as we have seen in NSW/VIC death statistics for the month of October/November and medium-long-term growth to be further supported by ageing baby boomers as the older cohorts reach average life expectancy in ~3 years. We also see unlocked value in PFP’s freehold property portfolio which sits on the Balance Sheet at cost, valued close to $220m less depreciation (BPe) and view this as a hedge to the net gearing level of 2.9-3.2x (management estimate).