A small miss on earnings, outlook remains positive

PME reported 1H25 revenues of $97.2m relative to consensus of $100m hence a 2% miss at the top line. EBITDA $72.9m relative to market consensus of $75m. PME continues to stick to core business of Visage 7, workflow, archive and data migration services where demand for its offering is increasing despite price rises and an influx of approvals of AI tools in the radiology space (but little/no reimbursement). The ongoing shortage of radiologist is showing no sign of abating, hence the productivity improvements delivered by the Visage platform remain a fundamental driver.

PME continues to win good new business in its traditional client base of Academic Medical Centres and Independent Delivery Networks, however, the recent win at Duly Health is pivotal. Private radiology is the lowest margin work in the sector and for this reason there has been considerable consolidation. For PME to win an RFP in this space would have been unheard of up until now and in our view this is another affirmation of the value proposition.

Guidance and Outlook

No guidance, none expected. Revenues continue to be highly transparent. Recent devaluation of A$ expected to add c. $6m to FY25 revenues, majority of which will flow to earnings. The pipeline continues to be described as strong across all classes and this translates to more contract wins imminent. In our long coverage of the stock, this description has never waivered. By virtue of the recently announced contract wins, FY25/26 revenues remain highly transparent.

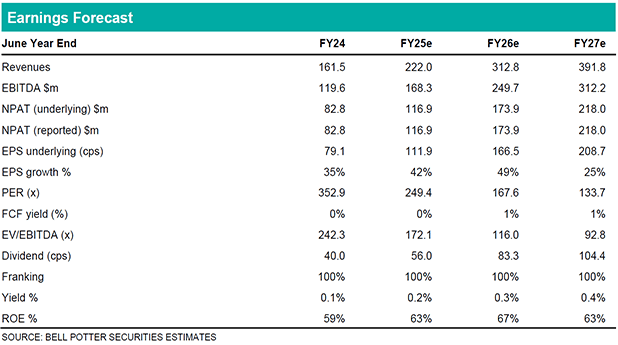

Investment View: Upgrade to Buy PT$330

The PME full stack solution continues to wipe the floor with competitors – 10 contract announcements in the LTM including two new academic medical centres clients. FY25/26 revenues upgraded by 4% and 2% respectively. In addition we expect further growth in the cardiology space with the first small scale implementation to take place in April 2025. Following earnings revisions we upgrade to Buy and price target $330.