Strong 1H22 trading update, Smiggle rebounding

PMV has provided a strong 1H22 update for its retail segment, with EBIT ahead of our expectations. We note PMV’s 1H22 period is for the 26 weeks ending 29 January 2022 and therefore includes the omicron flare-up exiting December and throughout January.

The key highlights of PMV’s 1H22 retail segment update are as follows:

- EBIT (pre-AASB 16 basis) expected to be in the range of $209.5m – $211.5m: Note, this includes rent abatements of $15.5m (i.e. EBIT range of $194 – $196m excluding abatements). The EBIT result is comfortably ahead vs BPe of $165.5m.

- Resilient sales result, with 1H22 Retail sales of ~$769m: On a comparable basis this represents growth of +0.5% vs pcp. This is a strong result considering the extended lockdowns through the period & the flare-up of omicron in Dec/Jan. The key drivers of sales include: 1) strong contribution from online with the online channel accounting for ~25% of total global sales; 2) the rebounding of Smiggle’s global business as children returned to school; and 3) continued outperformance from Peter Alexander and solid results from Portmans.

Earnings changes

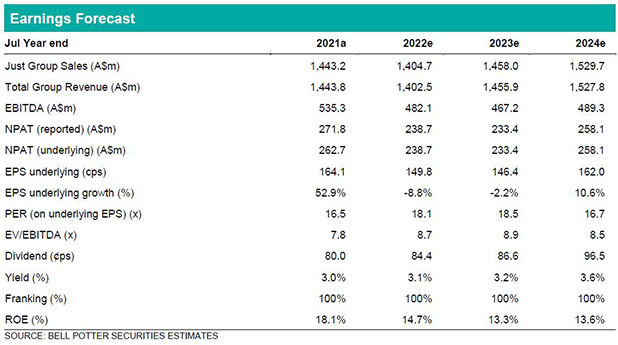

We have updated our 1H22 estimates to reflect the update. Whilst the 1H22 Retail EBIT result represents a material outperformance vs our estimate, we have elected not to carry tis forward given continued uncertainties surrounding COVID-19. Net effect is our FY22 EPS increases by +12.2%, although there is no material change in FY23 and FY24. Our 12-month price target increases to $32.00 (previously $31.25).

Investment View – Retain Buy, PT $32.00

PMV has been an outperformer throughout COVID-19, demonstrating resilient sales performance underpinned by market leading omni-channel capabilities that leverage off a wholly owned DC. We see several key positive catalysts over the next 12-24 mths including the continued rebound in Smiggle, the potential launch of Peter Alexander in new offshore markets, plus M&A opportunities. We retain our Buy rating on the stock.