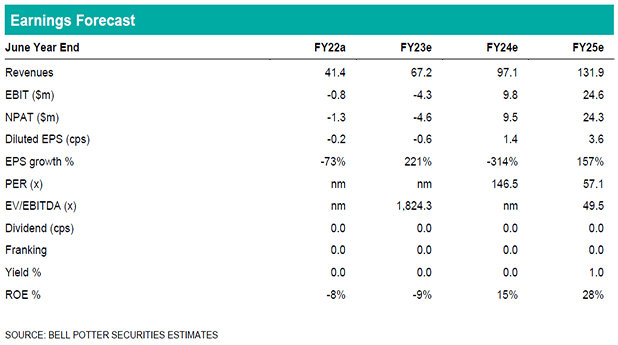

Bolstered pathway to profitability

The $30m placement conducted last week significantly strengthens the PolyNovo balance sheet. This provides the growth platform facilitating the expansion of the US and global sales team with key markets in Asia (India, Hong Kong, China, Japan) & Canada being targeted. An important driver in US commercialisation has been through additional commercial hires and the capital raising allows acceleration with this process. The company intends to hire ~ 30 new staff during FY23. Product launch within Hong Kong and India has already taken place during 1H23 whilst entry into Japan/China is planned through a distributor model. These new operating segments increase the addressable market especially in regions with a significant healthcare burden of burns and complex/trauma wounds. Recent BTM registration within Canada is also an important achievement as this simplifies the process to use BTM which was previously only accessible via the Canadian Special Access scheme on a case-by-case basis.

Overview of funds allocation

The company intends to use the $33m ($30m placement, $3m director placement subject to shareholder approval at EGM in January 2023) in geographical expansion through additional hiring ($6m) and manufacturing facility extension ($25m) to facilitate annual revenue capacity of ~ $500m and accelerate R&D projects (breast, hernia devices, therapeutics). Expanding indications involve BTM and MTX devices with the launch of SynPath in the diabetic foot ulcer market targeted in late CY23.

Investment view: Maintain Buy, Increase PT to $2.30

Our price target is now generated purely from our DCF methodology as this best captures the longer-term earning potential for PNV. The strengthened balance sheet reduces financial risk and accordingly we decrease the WACC from 10.3% to 10.0%. Combining these strategic developments, we expect PNV to be profitable from FY24 in line with company expectations and this growth strategy to translate to improved earnings in the medium- to long-term (FY26 onwards).