Another $2.5bn buy-back

NAB has announced the completion of its $2.5bn on-market share buy-back. In addition, it has also announced a further buy-back of up to $2.5bn. The total combined size is therefore $5.0n. This will enable NAB to manage its CET1 capital ratio towards the target range of 10.75-11.25%. The bank expects to commence the latest buy-back following its 1H22 result, subject to market conditions. The capital management strategy reflects its strong balance sheet, further saying “…the further $2.5bn onmarket buy-back announced today supports our ambition to reduce share count and increase sustainable ROE benefits for our shareholders”.

APRA’s Unquestionably Strong CET1 benchmark remains at 10.5%. While the reported ratio is at 12.4% at the end of December 2021, the further buy-back will reduce the Group’s CE1 ratio by roughly 58bp. Pro-forma including other adjustments, CET1 ratio is 11.3% and the movements include: 1) shares bought back and cancelled -32bp; 2) proposed acquisition of the Citigroup Australian consumer business -31bp; 3) BNZ divestment +6bp; and 4) further proposed buy-back of $2.5bn -58bp. This is subject to timing and number of shares purchased.

Price target increased to $34.50, Buy rating maintained

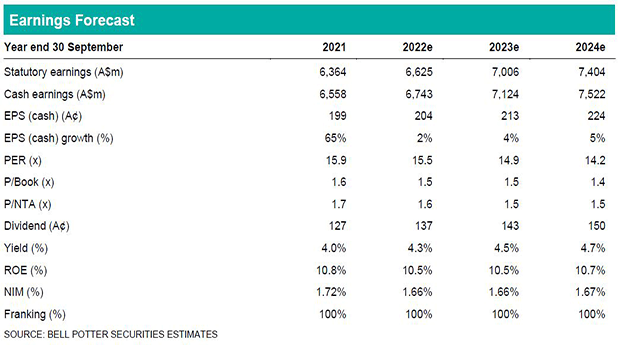

NAB’s cash earnings are increased by 3% from FY25e, mainly due to higher net interest income (up to 1% from FY25e) and even higher other banking income (3-12% in FY23e through to FY25e from reversion back to normalcy especially in business/private and corporate/institutional banking). These are offset to some extent by higher credit impairment charges (by up to 15bp – previously 12bp – in FY25e). In addition to lower dividend valuation yield of 3.75% (discount rate is maintained), the price target is therefore increased by $2.00 to $34.50. NAB’s Buy rating is retained.