Onwards and downstream with a bullet proof balance sheet

LYC highlighted the ‘Towards 2030’ strategy which includes two pillars 1) Harvest: returns through optimisation of the Lynas 2025 strategy and ramping current capacity in-line with current demand and 2) Grow: adding resource and scale, increasing separation capacity and expanding into the downstream ex-China metal and magnets sector. Following the A$750m placement the business has ~A$902m in liquidity, addressing issues of balance sheet stress and providing a platform to begin funding its strategic goals. Details on expansion potential are vague, which makes assessing the likely capital requirements of various ventures difficult. Reading between the lines: Seadrift is delayed until the US Govt comes to the table on funding, which pushes out 1.5ktpa in NdPr processing capacity, potentially Malaysia could expand downstream separation which would bring group production up to 12ktpa, however this would be later in the decade we suspect.

FY25 highlights – Higher depreciation drives a miss

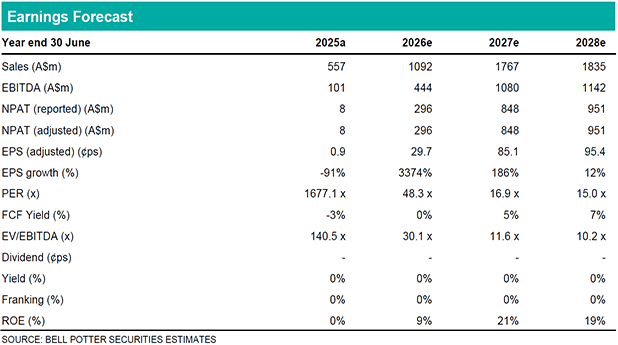

LYC reported FY25 highlights: Revenue of A$557m (BPe $547m, VA cons $547m); COGS (ex Depn) of A$382m (BPe $378m, VA cons $382m); EBITDA of A$101m (BPe $96m, VA cons $99m); NPAT of A$8m (BPe $32m, VA cons $37m); and EPS of A$0.86cps (BPe A$3.46cps, VA cons A$3.53cps).

Investment Thesis: Sell, Target Price $9.35/sh

Our Target price increases to $9.35/sh (previously $7.65), and we maintain our Sell recommendation. We do recognise that the current themes pushing LYC higher are likely to persist as tailwinds over the short term. We have seen the US play its hand with the MP Materials deal; this could form a blueprint for other sovereign investments. Despite this, we believe LYC is priced for perfection, with little room for error. EPS changes in this report: FY26 -8%, FY27 -7%, FY28 -15%.