More clarity likely with release of quarterly next week

Life360 is scheduled to release its Appendix 4C for 1Q2022 next Wednesday, 27th April and we expect this and other commentary by the company to provide more clarity regarding the outlook for 2022 and potentially beyond. Firstly we expect the quarterly will show continued strong y-o-y growth in the core business while we expect Jiobit and Tile revenue to be relatively flat. Secondly we expect an update on the proposed US listing and perhaps a decision on whether this is proceeding or being put on hold for now. If it is the former then we expect Life360 to again clarify that it will not conduct a capital raising around the current share price. If it is the latter then there is the potential for the company to provide 2022 guidance which it has been unable to do to date due to the listing process under US securities law. Additionally the company may even provide an expected pathway to profitability given this is a key focus of the market at present for loss making companies.

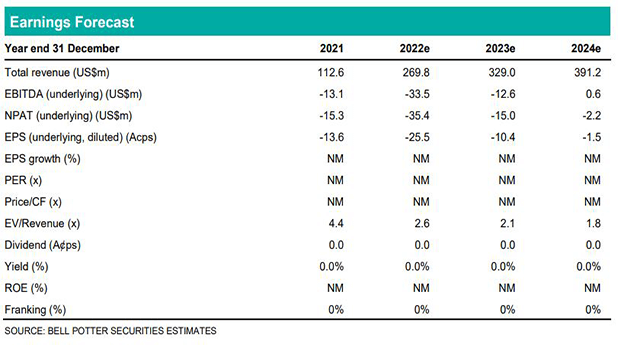

No change in forecasts

There is no change in our forecasts. We already forecast strong growth in the core business in 2022 (e.g. 38% revenue growth) and only modest growth for Jiobit and Tile. We then forecast continued strong growth in the core business in 2023 (e.g. 28% revenue growth) and stronger growth for Jiobit and Tile in the double digit percentages. We also continue to forecast underlying EBITDA losses of US$33.5m in 2022 and US$12.6m in 2023 and then a modest EBITDA profit in 2024. Note the company has more than enough cash to fund the forecast losses in 2022 and 2023.

Investment view: $10.00 PT unchanged, BUY maintained

While there is no change in our forecasts we have updated each valuation used in the determination of our price target for market movements and time creep. There are no changes in our key assumptions of no premium/discount in the EV/Revenue valuation and an 8.7% WACC and 5.0% terminal growth rate in the DCF. The net result, however, is no change in our PT of $10.00 and we retain our BUY recommendation. We see the release of the quarterly next week as a potential catalyst for the stock.