FY23e earnings guidance

Johns Lyng (JLG) has provided earnings guidance for FY23e. At headline level forecast revenue for FY23e (excluding the soon to be exited Commercial Construction division) has been upgraded by ~$110m to $1.19bn, marking an increase of 10.2% over Feb’23 guidance and representing growth of 47.7% vs. FY22.

CAT: JLG now expects revenue of $350.5m (prev. $240.5m in Feb’23) and EBITDA of $41.0m (prev. $29.0m). Annualising implied CAT work completed from Mar’23 to Jun’23 ($330m) continues to suggest a significant CAT run-rate for JLG (and we note compares to Sep’22 to Feb’23 at $336m annualised). At the recent investor day JLG highlighted it had secured US$78m in Hurricane Ian work in the US and that its engagement with local government continues to progress towards ‘standing’ (e.g. ongoing) contracts with State governments such as Qld and Vic.

BAU: JLG reiterated its BAU forecast for $837.6m (vs. BPe $847.5m) however underlying BAU EBITDA of $92.2m (excl. a $2.3m bad debt) was softer than our $99.3m. Compositionally we suspect the relative infancy of JLG’s USA business (e.g. front loading start-up costs to set up JLG’s ‘full service’ proposition) has driven the majority of the margin compression experienced in 2H23 (-90bps HOH to 10.5%).

Investment view: Downgrade to Hold

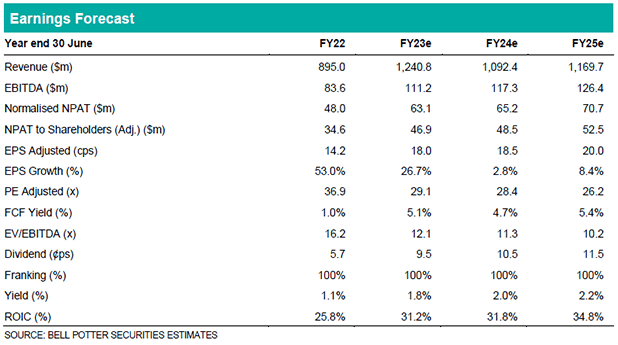

Our EPS changes are +2%, -9% and -8% in FY23-25e. Whilst still representing FY23e BAU revenue growth of ~30% YOY (~12-14% organic), we see JLG in the relatively early stages of cycling an elevated period of property claims growth of ~10% p.a. since 2020. As such our Hold recommendation is based on our expectations of a softer domestic demand outlook for JLG heading into El Niño, where we have observed falling property claims values in four of the last six events (with an average decline of – 1.6% to the cycle midpoint). Key offsetting considerations to our rating include: (1) JLG’s execution in the US and the potential to leverage domestic insurance relationships; and (2) JLG’s ability to diversify its revenue exposure to rain events and/or accelerate market share growth in the US through M&A.