A tough quarter

We expected Q2 to be tough, but the figures were worse than we expected. AUM fell by 17% from US$361bn to US$299bn, below our estimate of US$319.4bn. Adjusted operating income, was US$149.3m in Q2, which was 7.8% below our estimate of US$162.2m and down 16.5% compared to US$178.8m in the previous quarter. The dividend was kept at US$0.39 per share.

New CEO highlights areas of focus

The conference call was the first opportunity for Ali Dibadj to speak to analysts since he arrived (one month ago). He is conducting a review but pointed out that AUM and revenues and have not kept pace with the industry. He sees a lot to do to improve performance and acknowledged it would not be a quick fix. The company was not getting its share of new flows that would be suggested by the relative investment performance. A phrase he used repeatedly was “[win] where we have the right to win”. He was clear that he had been brought in to fix rather than sell the business, but there was a need in some areas to add to teams or make small bolt-on acquisitions.

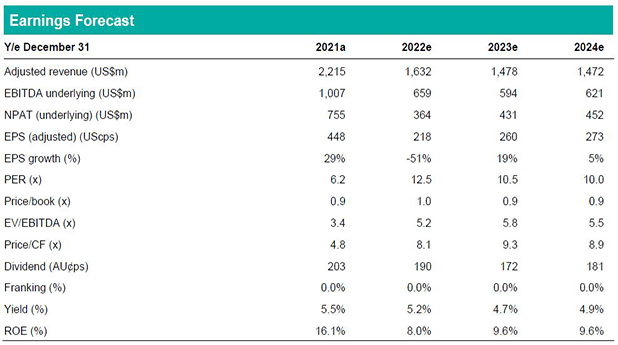

Investment view: Valuation A$43.50 per share, maintain BUY

The investment thesis is at a turning point. Falls in investment markets, have reduced AUM and profitability. The appearance of an activist investor has not led to corporate activity which may have disappointed some investors. The change of CEO means a new strategy and that will take time to deliver tangible results. But now might be a good time to revisit: markets should start to recover; the company has a new direction and there is still the prospect of M&A (we feel JHG could easily be swallowed by a larger group). We value JHG using DCF valuation, with a WACC of 11.2% which gives a valuation of A$43.33 per share at end 2022, which we round to a target price of A$43.50 (4.4% lower than our previous price target of A$45.50). This price target is 18.3% above the current share price and we retain a BUY recommendation. With this update our earnings forecasts reduce by 20.3% for FY22 and 7.2% for FY23 and FY24.