AGM update: Asia consistent growth continues, ANZ steady

At its AGM, IPH provided an overall positive trading update for the first four months to 31 October (FYTD). IPH has achieved growth in underlying like-for-like (LFL) EBITDA vs pcp driven by performance in Asia, moderated partially by the short-term impact of the Shelston IP – Spruson & Ferguson integration in Australia. Key highlights include:

- Asia strong organic like-for-like (LFL) growth continues: IPH’s Asia business has continued its strong performance and delivered positive FYTD LFL EBITDA growth vs pcp. Patent filings are up strong across the region including: Singapore (CY to end-Aug’21) up 23.1%; Asia ex. Singapore (to end-Sep’21) up 20.2%; and China experiencing “solid growth”. These strong patent filing numbers bode well for Asia’s EBITDA outlook, as filings progress to patent examination work flow.

- ANZ solid overall, with Griffith Hack achieving a strong recovery: IPH’s ANZ LFL EBITDA is steady vs pcp, reflecting the short-term impacts of the Shelston IP / Spruson & Ferguson integration. After filings contracted last year (Griffith Hack /

Watermark integration + COVID disruptions), Australian 1Q22 fillings rebounded +8.7% vs pcp. A key highlight is the recovery in Griffith Hack’s market share, with FYTD filings up +29.7%, confirming integration impacts in the pcp were one-off. - Shelston IP / Spruson & Ferguson Australia integration expected to realise $2.0-$2.5m in synergies: Shelston IP combined under the Spruson & Ferguson brand from 1 November with full systems integration to occur in December. IPH estimate synergies of $2.0-$2.5m p.a. will be realised, with a further cost savings on rent of ~$1m assuming the Shelston premises will be subleased. $1.0-$1.25m of EBITDA savings & ~$0.25m of rent costs are expected to be achieved in FY22.

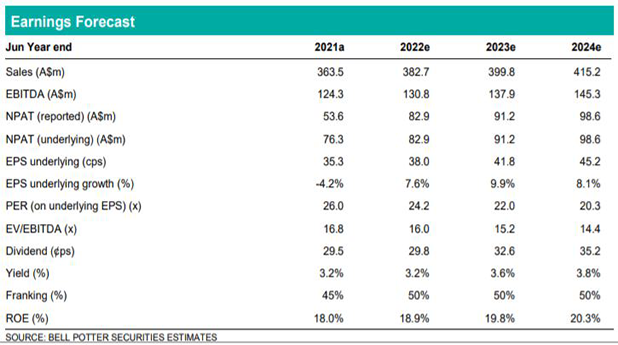

Earnings changes & Investment view: Retain Buy, PT $10.35

The lift in fillings bodes well for IPH’s outlook & accordingly we have strengthened our medium/long-term forecasts (mostly in Asia). No material FY22-FY24 EPS changes, although our longer term EPS est. increase. Including time-creep our PT increases to $10.35 (previously $9.90). IPH continues to deliver resilient through-the-cycle growth, underpinned by a quality client base, geographic diversification and a flexible business model. Plus there is upside from potential acquisitions. We retain our Buy rating