Revenue and PBT below our forecast, NPAT in line

Integrated Research (IR) reported 1HFY22 revenue and PBT below our forecasts ($32.2m vs BP $38.0m and $0.6m vs BP $2.2m) but NPAT was close to in line ($1.8m vs BP $1.7m). The make-up at NPAT was driven by a tax benefit of $1.2m rather than a tax expense which we were forecasting. The result also included other gains of $2.2m – driven by currency exchange movements – which we had not forecast and lowered the quality of the result. Operating cash flow fell 23% to $8.7m but the cash flow conversion was good at 92% (and there was no debtor factoring). The net cash position improved from $5.5m at 30 June to $9.4m at 31 December. There was no interim dividend but we did not expect any.

Guidance of NPAT growth

IR did not provide any specific guidance but did say it expects both TCV and NPAT to grow relative to FY21. On the conference call the company also said it expects pro forma revenue to be similar in H2 to H1 implying 2HFY22 pro forma revenue of around $80m (though it was not clear what this implies for statutory revenue). IR said it is confident of a better 2H relative to 1H on the back of more renewals, recent product releases and a strong pipeline of opportunities with both new and existing customers.

EPS downgrades

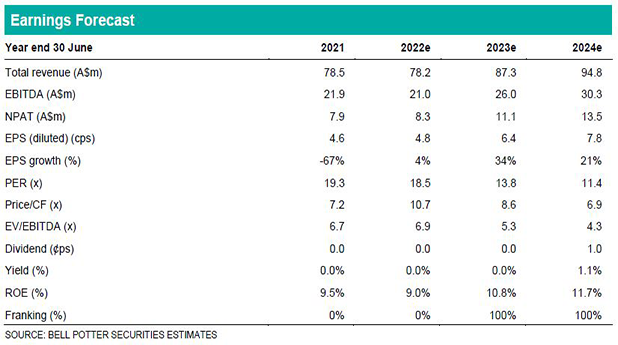

We have downgraded our EPS forecasts by 11%, 21% and 21% in FY22, FY23 and FY24. The downgrades have been driven by 7-8% reductions in our revenue forecasts and also reductions in our margin forecasts.

Investment view: PT down 33% to $1.00, Maintain HOLD

We have updated each valuation used in the determination of our price target for the earnings changes and also increased the discount in the relative valuations from 30% to 40% and the WACC in the DCF from 9.2% to 9.7% given the weaker-than-expected H1 result. The net result is a 33% decrease in our PT to $1.00 which is <15% premium to the share price so we maintain our HOLD recommendation.