Earth Science capabilities strengthen via acquisitions

IMD has entered into binding agreements to acquire 100% of Advanced Logic Technology S.A. (ALT) and its subsidiary Mount Sopris Instruments Inc. (MSI), global leaders in borehole geophysical imaging solutions, imaging probes and accompanying visualisation and data processing software. These acquisitions are expected to expand IMD’s TAM in the mining, infrastructure, environmental and energy sectors. The ALT and MSI acquisitions will complement IMD’s existing rock property sensor offering and digital earth knowledge capabilities; under the EarthNet platform IMD seeks to create a unified, open platform for earth systems data analytics, supporting smarter and faster decision making for clients.

Consideration payments, financing & accretion: Combined upfront consideration is A$98.9m. Up to A$35.4m of earn-out payments are linked to deployment of technology being trialled and an incremental revenue share framework over a three year period post deal close. The deal will be financed with cash and existing debt facilities. The deal is expected to close in 3Q FY26. The acquisition is expected to be EPS accretive in the first year of ownership before the inclusion of any cost and revenue synergies.

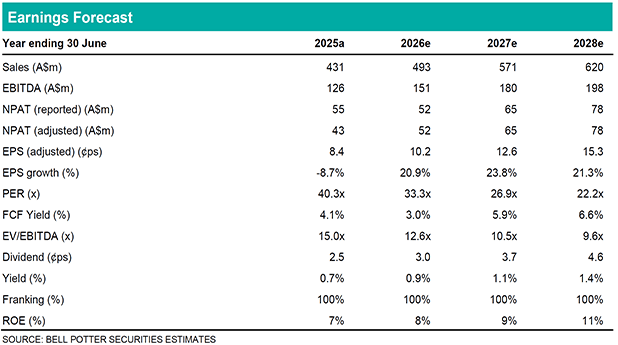

EPS changes: Reflect the integration of the ALT and MSI acquisition and alignment of FY26 PnL guidance (see page 3), with higher D&A and finance costs to carry into FY27-28. We assume ~$39m of incremental revenue from ALT and MSI by the third year post deal-close (25% of earn-out 2 cap). EPS changes are: -9% in FY26; -1% in FY27; and +6% in FY28.

Investment thesis: Hold; TP$3.60/sh (prev. $3.90/sh)

Our Target Price is lowered to $3.60/sh after applying a higher WACC 8.7% (previously 7.8%). Value accretion from the ALT and MSI acquisitions is dependent on meaningful incremental revenue generation over the three year period post deal completion. For example, achieving 25% of the incremental revenue share earn-out cap (our base case) should deliver an implied acquisition multiple of 7.1x (EV / FY28 EBITDA), less than IMD’s 9.6x (in FY28). Implied upfront valuation multiple is closer to 20.6x FY26 EBITDA.