1Q24 student visa data

IDP’s student placement (SP) volumes typically correlate with student visa data from key source markets: India, China, Vietnam, Australia, Nigeria, and Thailand (77% of enrolments) into key destination countries: Australia, the UK and Canada (93% of enrolments). 1HFY24 is typically seasonally weaker for SP volumes in Australia, which was evident in visas granted across IDP’s key source countries in Q1 -12% on the pcp to ~28k and -29% QoQ however, this remains slightly above pre-pandemic levels.

Monthly data also continued to portray a normalisation of visa grants with September – 32% on the pcp and grant rates declining with record applications lodged and tougher visa policies. Northern hemisphere data on the other hand was encouraging, particularly for Canada. As the seasonally strongest quarter for both Canada and the UK, visa permits/ grants were +33% and -4% on the pcp to 302k holders (both ~60% higher than pre-pandemic levels).

Changes to forecasts

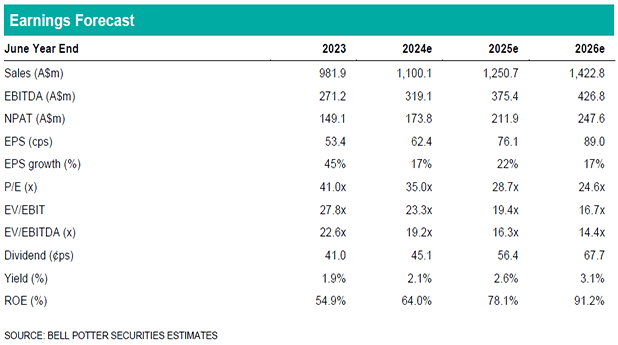

We are more conservative on IDP’s Australian SP outlook with recent data portraying a normalisation of visas issued along with lower grant rates and the possibility of the Australian Govt. introducing policies to cap international student numbers to lower record migration levels. The modest downgrades to our Australia SP assumptions were more than offset by an increase in our multi destination forecasts supported by encouraging northern hemisphere data. The net result was revenue upgrades of ~1- 2% in FY24-25e. We have also reduced our opex forecasts resulting in more material EBITDA upgrades of 10%, 7% and 2% in FY24-26e.

Investment view: PT +1.1% to $27.00, Upgrade to BUY

We have updated each valuation used in the determination of our PT for the forecast changes and recent market movements. There is no change to our 30x EV/EBIT valuation assumption however, we have increased the RFR in our DCF resulting in a WACC of 8.4%. The net result is a 1.1% increase in our PT to $27.00 which is a >15% premium to the current share price so we upgrade to a Buy recommendation.