1H24 results at a glance

AAC reported 1H24 Operating EBITDA ahead or our expectations at $30.1m. Key operating statistics of the result included:

Operating results: Revenue of $169.1m was up +5% YOY (vs. BPe $151.5m). Operating EBITDA of $3.1m was down -21% YOY (vs. BPe $19.4m). Liveweight (lwt) sold was up +16% YOY, however, revenue per Kg lwt was down -10% YOY and EBITDA per Kg lwt sold was down -32%, reflecting lower live sales values (down -29% YOY). Statutory EBITDA loss of -$124.9m, includes -$175.5m unfavourable movement in herd values.

Cashflow and balance sheet: Lease adjusted operating cash outflow of -$6.3m compares to a -$1.2m outflow in 1H22. Net debt exited the period at $410.6m and compares to net debt of $386.7m at FY23 (and $421.6m at 1H23). NTA exited at $2.39ps and compares to $2.57ps at FY23 (and $2.33ps at 1H23) and reflected the impact of unfavourable cattle value movements in the period.

Outlook: No formal guidance. Most material aspects of qualitative outlook include the expansion of the Goonoo feedlots adding up to +12% in capacity and successful cropping trials over 6,000Ha of northern properties (which is consistent with AAC’s plan to improve the productive capacity of the land assets).

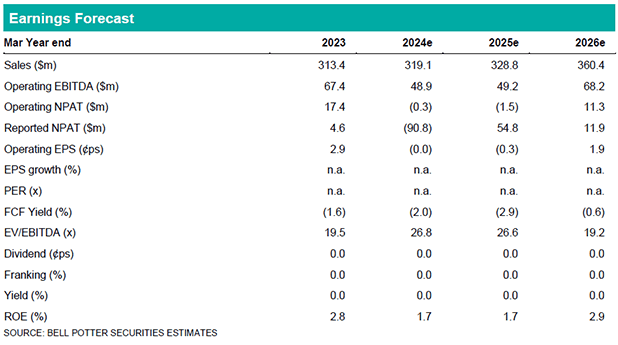

We have raised our operating EBITDA forecasts by +38% in FY24e, +89% in FY25e and +76% in FY26e reflecting higher meat volumes, higher live pricing assumptions and lower production costs. Our NAV based target price lifts to $1.90ps (prev. $1.85ps) in light of the recent cattle price movement.

Investment view: Retain Buy rating

Our Buy rating is unchanged. AAC continues to demonstrate growth in through the cycle returns as the revenue shifts from cattle to meat. Importantly, with the expansion at Goonoo this is likely to remain a feature through FY25e. We view the 44% discount to NTA as excessive (and at the upper end of discounts we are seeing in other listed farming assets) particularly in light of the post balance date ~23% rally in cattle prices.