Material international student policy changes in Canada

The Canadian Government has announced several material policy changes targeting international students: (1) an intake cap on international student permit applications for the next two years (in 2024 the cap is expected to result in 364k approved study permits, -35% from 2023). Study permit renewals/ current study permit holders will not be impacted and master’s/ doctoral degrees are not included in the cap; (2) Post-Graduation Work Permit Program eligibility criteria changes (from Sept-24 international students who begin a study program that is part of a curriculum licensing arrangement will not being eligible for a postgraduation work permit however, Graduates of master’s and other short graduate-level programs will soon be eligible to apply for a 3-year work permit); and (3) open work permit eligibility criteria changes with permits now only available to spouses of international students in master’s and doctoral programs and not undergraduate and college programs.

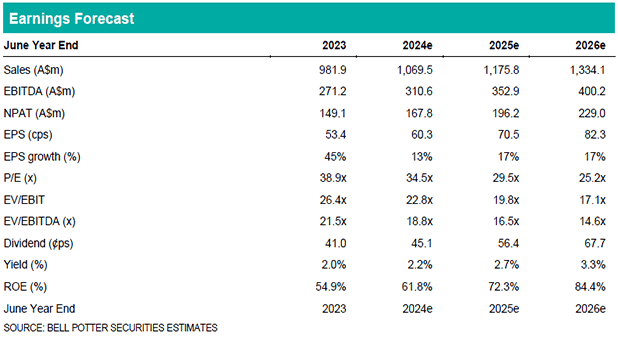

Investment view: PT -7.4% to $25.00, Retain Buy

Whilst the exact implications of these changes on IDP are unclear, we expect international demand for both study and work opportunities in Canada to be significantly impacted. Canada is a large market for both IDP’s student placements (SP) (24% of course enrolments) and IELTS exams (BPe ~40%). We have assumed a ~10% reduction in our forecast student placement volumes and ~6% decline in IELTS volumes given our forecasts were already conservative. There are no changes to our 1H24 forecasts. The net result is EPS downgrades of -3% in FY24 and -7% in FY25- 26e. We expect the company will provide commentary on these changes at the 1H24 result on the 14th of February.

We have updated each valuation used in the determination of our PT for the forecast changes and recent market movements. To account for recent weakness and risk surrounding these policy changes, we have reduced our EV/EBIT valuation multiple to 30x from 29x however, our DCF assumptions remain unchanged. The net result is a -7.4% decrease in our PT to $25.00 which is a >15% premium to the current share price so we retain our Buy recommendation.