Transfer of coverage; positive view maintained

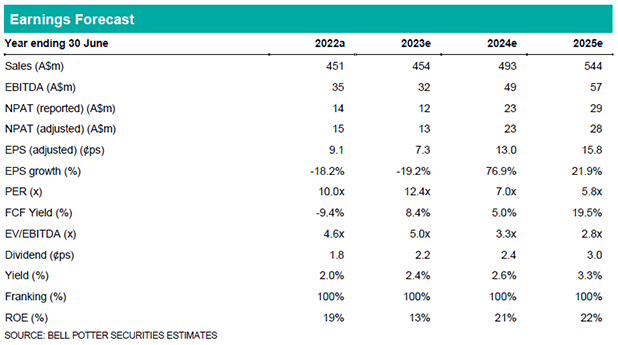

We have transferred GNP analyst coverage; we maintain our Buy recommendation with a Target Price of $1.18/sh (previously $1.72/sh). Our updated investment thesis is underpinned by: (1) a strong EPS growth outlook beyond FY23, with growth of +77% in FY24 and +22% in FY25, driven by an increasing revenue profile to capture largescale power infrastructure development activity on the east coast of Australia, and as labour and material cost relief materialise; (2) ongoing profitability improvements and scaling of the company’s Communications division which has undergone restructuring during FY22 and early FY23; (3) a well capitalised balance sheet to support further EPS and value accretive acquisitions; and (4) an unwarranted relative valuation discount of ~50% compared with sector peers (considering EV/EBITDA). Our EPS changes reflect revisions to our revenue growth, EBITDA margin and D&A expense outlook: FY23 -43%; FY24 -17%; and FY25 -5%.

FY23: a year of consolidation and margin stabilisation

We expect FY23 will be a year of revenue growth moderation as the company completes the restructuring of its Communications division to improve profitability, and as it integrates the recent L&M Powerline Construction acquisition (announced January 2023). Gross profit and EBITDA margins have already started to show signs of stabilisation with notable improvements in raw material expense and indirect costs (as a % of revenue) in 1H FY23. Beyond FY23, GNP’s order book and tender pipeline implies increasing recurring work activities and delivery of large-scale projects, including Transgrid’s HumeLink 500kv Transmission Project in NSW.

Investment thesis: Buy, TP$1.18/sh (prev. $1.72/sh)

GNP is leveraged to increasing renewable power, battery energy storage and transmission infrastructure investment on the east coast of Australia, which extends from its mature Western Australian power infrastructure operations, where it services Resources focussed customers. GNP is well positioned to scale its recently restructured Communications and Industrial Services divisions via potential NBN opportunities and EPC delivery of battery energy storage projects, respectively.