1HFY22 financial result

FMG announced its 1HFY22 financial results, which reported record half year production volumes but lower revenue, EBITDA and earnings. The weaker financial metrics reflected iron ore prices retreating from record highs, higher operating costs, downward provisional pricing adjustments and wider grade and quality discounts. Key metrics included revenue of US$8,125m (vs BPe US$8,067m and down 13% vs pcp), EBITDA of US$4,762m (vs BPe US$4,980m and down 28% vs pcp) and NPAT of US$2,779m (vs BPe US$2,981m and down 32% vs pcp). The declaration of a fully franked interim dividend of A86cps (vs BPe A90cps and down 41% vs pcp) represented a payout ratio of 70% (vs 80% pcp) and equates to a fully franked yield of 4.0% in its own right. The ex-dividend date is 28 February 2022.

Robust margins but valuation question remains

The result was in-line or marginally below our expectations. To put the performance into perspective: the 1HFY22 interim dividend is FMG’s second highest ever, yet 1HFY22 earnings were 15% below its 1HFY21 dividend (let alone the earnings), which benefitted from high iron ore prices and lower costs. The robustness of FMG’s financial performance continues to be demonstrated by 1HFY22 EBITDA margins of 59%. While down from 71% vs the pcp, they remain some of the highest in the sector. Unfortunately, Fortescue Future Industries (FFI) remains a bit of a black box, in that while it is critical to FMG achieving its objective of decarbonisation by 2030, its value accretion and optionality added to the core business cannot be quantified. In our view, this is currently the key to closing the gap to a “Buy” recommendation.

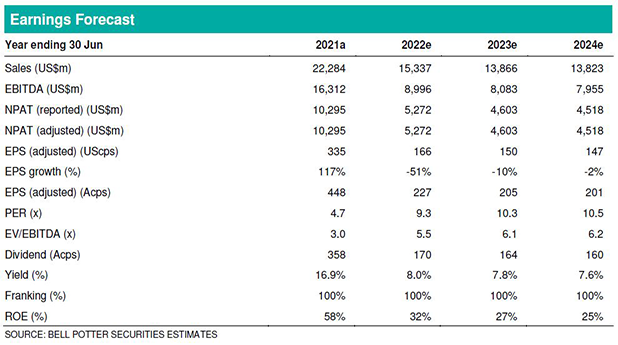

Investment thesis – Hold TP$19.09/sh (Hold TP$18.33/sh)

Larger grade and quality discounts and increased costs expensed by FFI are the primary drivers of a moderate trim of our earnings forecasts. Our forecast FY22 and FY23 earnings are lowered 7% and 4% respectively. Our lowered FY22 dividend of A170cps equates to an 8.0% fully franked dividend yield. Our NPV-based target price increases by 4% on our increased forecast contribution from Iron Bridge and an increased notional valuation for FFI. The dividend yield supports our Hold rating.