Superannuation and Financial Planning Summary

Last night Treasurer Josh Frydenberg delivered his fourth Budget, with an election on the horizon Frydenberg says the Budget delivers immediate relief to the cost of living, a long-term economic plan that creates jobs, record investments in essential services and stronger defence and national security.

The Budget forecasts the 2022-23 deficit to be $78 billion, or 3.4% of GDP. Over the next three years, this will more than halve to 1.6%. The unemployment rate is also forecast to drop to 3.75% by the September quarter, currently at 4%.

Net debt for the 2021-22 year is $631.5 billion, increasing to $714.9 billion for 2022-23 and by 2025-26 net debt is projected to be $865 billion or 33.1% of GDP.

Cost of living relief

To respond to immediate cost-of-living pressures the Budget unveiled the cost of living package which includes the following:

- Reducing the 44.2c-a-litre fuel excise for six months down to 22.1c, which took effect at midnight on Tuesday.

- A one-off, tax-exempt cash payment of $250 to six million pension and welfare recipients during April 2022.

- A $420 cost of living tax offset for 10 million low and middle-income earners, that is, those earning under $126,000. When combined with the low-and middle income tax offset (LMITO) eligible Australians will receive $1,500 for a single income or $3,000 for a couple.

Home Guarantee Scheme and new Regional Home Guarantee

The Budget proposed an expansion of the Home Guarantee Scheme adding a specific boost for homebuyers in regional areas.

Each year 10,000 guarantees will be available under the Regional Home Guarantee to support homebuyers, including non-first-time buyers, to build or buy in regional areas.

The original Home Guarantee Scheme will expand to 35,000 places starting 1 July 2022 and there will be 5,000 places available to help single-parent families to purchase with a 2% home loan deposit without incurring lender’s mortgage insurance.

Superannuation

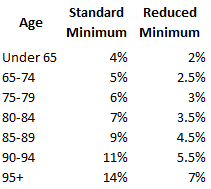

Announced pre-budget night and originally intended to provide relief during the COVID market shock, the temporary minimum drawdown rates will continue into the 2022-2023 financial year. The pension minimums will continue as follows:

Aged care

To continue implementing recommendations from the Royal Commission into Aged Care Quality and Safety the Budget committed $468m over five years which follows the record investment in the 2021-22 Federal Budget. The spending will continue to support the following:

- Home care

- Residential Aged Care Services and Sustainability

- Residential Aged Care Quality and Safety

- Workforce

- Governance

The government also committed $345.7m over four years from 2022-23 to embed pharmacy services within residential aged care facilities to improve medication management for the elderly.

Get in touch

If you would like to discuss the 2022-2023 Federal Budget further, please do not hesitate to contact your adviser.