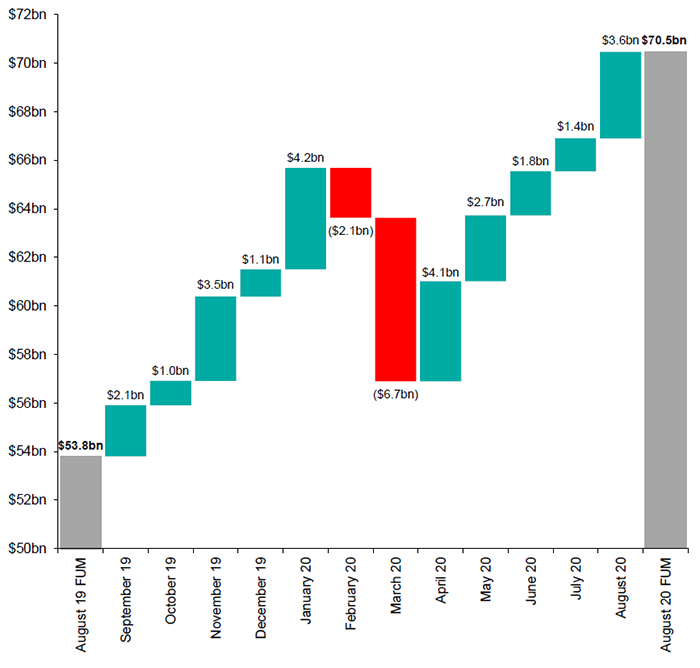

ETF funds under management on the rise

SPDR S&P/ASX 200 ESG Fund (E200)

The investment objective of E200 is to provide an investment return that aims to match the performance of the S&P/ASX 200 ESG Index (the “index”), before taking into account fees and expenses.

Index objective

The S&P/ASX 200 ESG Index is an opportunity for responsible investors to gain access to improved ESG characteristics, while achieving a risk-return profile comparable to that of the S&P/ASX 200.

Investment approach

In seeking to achieve the investment objective, the Responsible Entity will employ a passive investment strategy, investing in a portfolio of securities designed to reflect the characteristics of the fund’s index. Those securities can include index constituents and derivative contracts, including exchange traded futures contracts and options over index constituents (in limited circumstances). Small cash balances are also maintained for purely operational purposes.

The index is a broad based, market-cap weighted design intended to measure the performance of securities meeting ethical and sustainability criteria, while maintaining similar overall industry group weights as the S&P/ASX 200. This is achieved through negative exclusion screens on companies with business activities related to thermal coal, tobacco and controversial weapons. Companies are then ranked according to their S&P DJI ESG Scores, with constituents selected on a best-in-class basis relating to ethical, social and responsible corporate governance factors. It targets 75% exposure within each of the S&P/ASX 200 GICS industry groups on a float-adjusted market capitalisation basis. Constituent securities are then weighted accordingly. The index generally rebalances annually effective after the close of the last business day in April. The rebalancing reference date is the last trading day of March.

Risks

Please refer to Section 2 of the SPDR Australian Sector, Yield & ESG ETF PDS (24 Jul 2020).

Domestic Equity ETFs

Vanguard Australian Shares Index ETF (VAS) and VanEck Vectors Australian Equal Weight ETF (MVW) received the largest net fund inflows over the month with $77.6m and $77.4m respectively. Following the preceding month’s drawdown, total domestic equity FUM recovered and bolstered, reaching new all-time highs.

BetaShares S&P/ASX Australian Technology ETF (ATEC) returned to the forefront as a positive outlier, providing an extreme monthly return of 13.2%. As at 15 September, ATEC included 50 constituent securities with dominant portfolio weights in Afterpay Limited (18.4%) and Xero Limited (10.7%). Interestingly, there is still room for further inclusion in the index and fund portfolio. The benchmark S&P/ASX All Technology Index measures the performance of ASX-listed tech companies, as defined by their inclusion in the Information Technology GICS sector and certain specified GICS sub-industries. This is weighted by float-adjusted market capitalisation, subject to a single constituent weight limit of 25% of the total index. Stocks also require a minimum relative liquidity of 30% for inclusion, which may in turn further exacerbate this portfolio significance bias. We continue to stress the diversification benefits that may be better achieved though equal weight index methodologies. Risk mitigation still remains one of the fundamental uses of ETFs in a client’s overall portfolio.

In comparison, BetaShares Australian Equities Strong Bear Hedge Fund (BBOZ) delivered the lowest return for the month at -6%. The fund is ultimately tailored for risk mitigation, seeking to generate magnified returns that are negatively correlated to the movement in Australian equities. While the fund does not borrow for investment purposes, it aims to achieve a geared short exposure via ASX SPI 200 futures. Despite the return, BBOZ experienced net inflows of $16.9m for the period. This may serve as an indicator of changing investor sentiment and provide a contrarian view to the increase in domestic equity FUM. The substantial $70.3m net outflow recorded from BetaShares Australia 200 ETF (A200) may also further support this perspective.

Global Equity ETFs

Net inflows of $780m into global equity ETFs were recorded over August as total FUM went from strength to strength. The activity now marks three consecutive months in which fund flows have continued to increase. In particular, BetaShares NASDAQ 100 ETF (NDQ) saw the majority of net fund inflows at $81.5m. The passive strategy seeks to provide an investment return, before fees and expenses, in line with the performance of the Nasdaq 100.

Following on from this, the top performing ETF for the month was newly listed ETFS Ultra Long Nasdaq 100 Hedge Fund (LNAS), delivering investors with a return of 26.5%. The investment objective of the fund is to provide geared returns that are positively correlated with; and significantly magnified against the performance of the Nasdaq 100 Index (both up and down). LNAS achieves a levered position through its use of futures contracts. Exposure is also currency hedged, with the fund manager aiming to reduce AUD/USD exchange rate risk. The utility and on-screen liquidity provides investors with the ability to express high conviction views on the outcome of future events and market performance. We again note that leveraged ETFs are designed for short-term activity and are therefore not buy and hold positions.

Outside of the geared short exposures, VanEck Vectors Gold Miners ETF (GDX) was the lowest performing ETF with a return of -4.9% for the month. While precious metals continue to be a reliable store of wealth exhibiting defensive qualities, the bullion itself provides no income or exposure to corporate earnings. GDX aims to provide investment returns in line with the NYSE Arca Gold Miners Index – which is intended to track the overall performance of globalised companies in the gold mining industry. Top holdings within the fund currently include Newmont (12.9%), Barrick Gold (12.6%), and Franco-Nevada (6.8%). At this same time, GDX also has an approximate 80/20 split between large and mid capitalisation companies respectively. Thus, the investment vehicle provides exposure to companies with cash flows and valuations that rise in line with the price of gold and the sentiment that

influences it.

Fixed Interest ETFs

Domestic fixed interest ETFs rebounded and strengthened, with net fund flows increasing by $111m from the previous month. This was predominantly due to investor demand in the BetaShares Australian High Interest Cash ETF (AAA). The investment objective is to provide regular monthly distributions and a high level of capital security. The fund aims to achieve a return that exceeds the 30 day BBSW. AAA has now seen the greatest flows for 3 consecutive months. This may be an indication of high risk aversion and the need for regular sustainable income. Meanwhile Vanguard Int. Fixed Interest $A Hedged ETF (VIF) saw the majority of fund inflows between global fixed interest mandates. However a strengthening Australian dollar, Fed rate cuts and large US money supply may weigh on future returns.

Commodity & Currency ETFs

Following last month’s jump in the price of gold, investors yet again flocked towards commodity ETFs as a safe haven. While there were still substantial net inflows, this slightly tapered and declined from July’s resurgence, with $184m entering into the sub-sector. Monthly returns for gold spot trackers such as ETFS Physical Gold (GOLD) and Perth Mint Gold (PMGOLD) did not provide the same aggressive returns, however there is still room for a revival with extreme market volatility and huge fiat money printing. Unexpectedly large net outflows were recorded for currency ETFs, with a rush out of USD exposure being underpinned by a weakening dollar. The Australian dollar appreciated relative to it’s American counterpart, trading up around 73c by the end of August. Consequently we saw a $66.4m net movement out of the BetaShares U.S Dollar ETF (USD). USD tracks the exchange rate movements between these two currencies with the fund providing positively correlated 1:1 return against the U.S. dollar.